“The four most dangerous words in investing are: “This time it’s different.” “

– Sir John Templeton, British banker, fund manager, and philanthropist

During 2021 most fund managers’ opening line was: “This is going to be a ‘tough’ year – a lot of volatility driven by uncertainty”. At the end of the year, all your funds ended with positive returns, including some moderate to aggressive risk mandates that offered the client 20%+ returns.

Now it’s the year 2022 and guess what the fund managers’ opening line is: The main theme this year is no longer covid-19, but Putin. As this new uncertainty unfolds, we want to advise all clients to stay calm and well-informed.

To date, we’ve seen markets react negatively to the news and we are well aware of the massive attention that the Russia/Ukraine events are getting in the press. From an advice perspective, we will keep you well informed via our monthly market overview and your scheduled reviews.

The main indicators that we follow are currencies, energy and commodity prices, and the impact on specific equities.

From our side, we always implement a well-diversified investment strategy across all asset classes, of which some will be affected by the current events. By means of a diversified choice of investment managers, as well as taking an active approach to asset allocation, we aim to protect your capital whilst still seeking opportunities in these uncertain times.

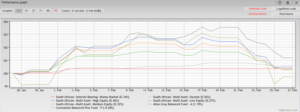

The graph below indicates the 12-month returns for money markets, income funds, low to medium equity, and high equity funds. The returns range from 3.83% on the money market to 12.32 % on funds with high equity exposure.

The following graph shows returns for the same fund sectors over the last month. We included two balanced funds (Allan Gray and Coronation). The graph demonstrates capital protection within the strategies/funds over the last month, with only Coronation that dipped below 0.28%.

Conclusion:

All client portfolios are well diversified and will prioritize the protection of capital. Let’s give our selected fund managers the opportunity to do their work and allow them to use this “opportunity”, backed by their thorough research on investment opportunities that will offer inflation-beating returns in the future.