Skip to content

Marketing Report: September 2025 in Review

September 2025 In Review

Macro: Global Growth Holds Steady Amid Rate Optimism

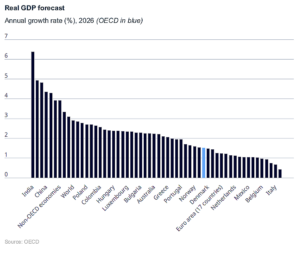

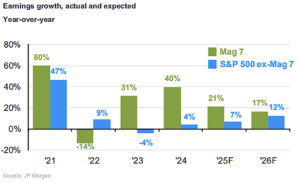

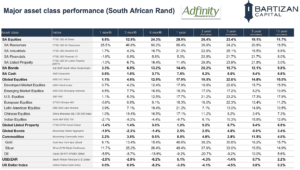

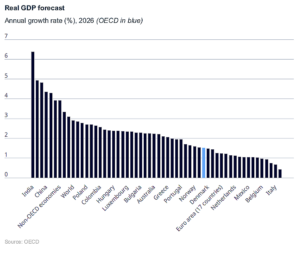

Global markets closed out the third quarter on a broadly positive note, buoyed by easing inflation pressures and growing expectations that the U.S. Federal Reserve could soon begin lowering interest rates. Economic data remained encouraging, suggesting that global growth is holding up despite geopolitical uncertainty. Enthusiasm surrounding artificial intelligence continued to fuel equity markets, with growth stocks outperforming value once again. Emerging markets led the way, supported by a robust rebound in Chinese equities, while developed markets also advanced steadily. Even the global bond market, which has faced headwinds for much of the year, managed to post modest gains as investors began to price in a gentler policy outlook from central banks.

Equities: Asia shines, U.S. and U.K. stay strong

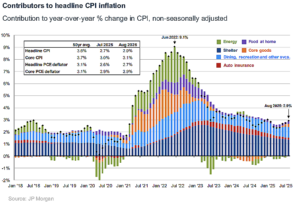

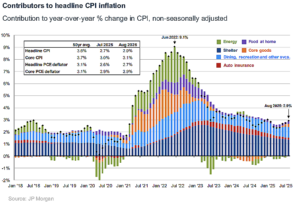

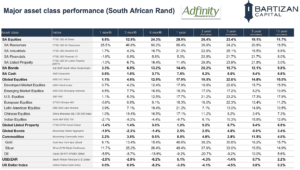

Across global equities, Asia was a key driver of returns. The MSCI Asia ex-Japan Index climbed more than 11%, propelled by a powerful rally in Chinese technology stocks. The Hang Seng Tech Index soared over 20% in the quarter and nearly 50% year to date, marking a striking turnaround for a market once dismissed as “uninvestable.” Japan also contributed positively, benefiting from a weaker yen and improving trade flows. In the U.S., the S&P 500 advanced roughly 8%, underpinned by solid earnings and resilient consumer spending. Although inflation edged slightly higher to 2.9% in August, the Fed delivered a 25-basis-point rate cut in September – its first this year – signalling a shift toward a more accommodative stance. The U.K. and Europe delivered more moderate performances. U.K. equities rose about 7%, aided by a softer sterling and strong global demand, while continental markets lagged, with the MSCI Europe ex-U.K. Index up just under 3% amid weakness in German manufacturing.

Fixed Income: Bonds Regain Their Balance

Fixed-income markets provided a welcome source of stability. U.S. Treasuries produced positive returns as investors refocused from inflation to slower-growth risks. European and U.K. bonds were mixed, constrained by lingering inflation and fiscal challenges, while Japanese government bonds softened as political uncertainty and hawkish signals from the Bank of Japan unsettled investors. Nonetheless, global bonds as a whole regained footing, demonstrating renewed value as a diversifier and income source.

Local Focus: South Africa Delivers a Standout Quarter

Back home, South African equities had a stellar September, with the FTSE/JSE All Share Index recording its best month of 2025, up 6.6%. That strength lifted quarterly gains to nearly 13%, the strongest in more than five years, and brought year-to-date performance to an impressive 32%. The rally was powered by precious metals, as platinum miners surged around 46% and gold producers climbed 27% for the month. Precious metals prices themselves rose sharply, with platinum up about 15% and gold up 12%, extending year-to-date increases of 74% and 47%, respectively. Domestic shares also played their part. Retail heavyweight Shoprite rose 6% on the back of strong full-year earnings growth, while FirstRand added 4% despite a large UK-related provision, supported by solid profit growth.

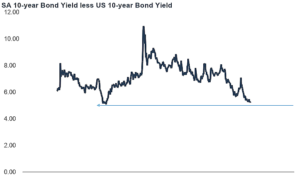

Rates, Bonds and the Rand

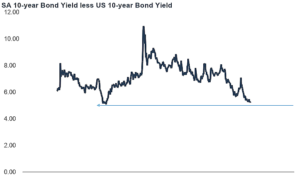

The South African Reserve Bank opted to hold the repo rate at 8.25%, keeping the prime lending rate at 10.5%, even as two members of the Monetary Policy Committee pushed for a cut. Policymakers reiterated their commitment to lowering inflation toward the 3% midpoint target. Bond markets responded positively, and the 10-year government yield fell to about 9.2%, its lowest in over four years, narrowing the spread versus U.S. Treasuries to its tightest since 2013. The rand also strengthened, gaining around 2.5% against the U.S. dollar in September and extending its year-to-date advance to nearly 9%. Improved global risk sentiment, easing bond yields, and a steadier dollar backdrop all contributed to renewed currency resilience.

Outlook: Staying Balanced Amid Shifting Conditions

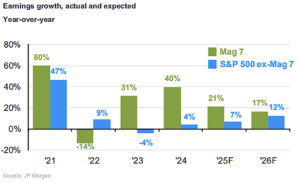

Looking ahead, global markets appear well-positioned but not without risk. Concentration in U.S. technology remains high, while inflation and policy surprises could still unsettle sentiment. For investors, maintaining a diversified approach across regions, sectors, and asset classes remains key.

Page load link