October 2025 In Review

Global Backdrop: Good News, But With Caution

The global investment landscape presented a mixed, but overall resilient picture in October. Developed-market equities rose by around 2.0% in U.S Dollar terms, while the Bloomberg Global Aggregate Bond Index slipped by about 0.3%. Growth-oriented stocks, especially those tied to artificial intelligence and tech, outperformed the more “value-” or “interest-rate”-sensitive segments. Meanwhile, the buoyant mood in equity markets benefitted from easing trade tensions – particularly between the U.S. and China – and a generally softer inflation backdrop in key regions. However, with markets returning close to all-time highs (and valuations), there’s a growing sense that much of the positive news is already priced in, meaning the margin for error is shrinking.

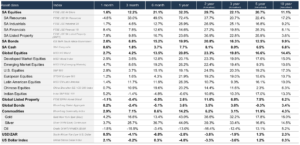

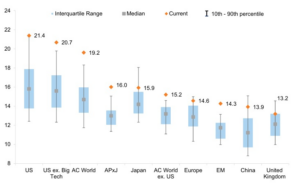

The US market is experiencing the most extreme valuations, in both absolute & relative terms 12 month forward P/E multiple. MSCI Regions, STOXX 600 for Europe and S&P500 for US.

Source: Goldman Sachs Global Investment Research, FactSet Research Systems. Data since 2003

Equities: Tech and Growth Lead, But Some Elements Lag.

Growth stocks outpaced value, with growth up ~4.2 percent versus value at ~0.4 percent. The enthusiasm around AI and related sectors continues to buoy the market. On the regional front, Japan out-performed among developed markets, helped by a weaker yen and expectation of expansionary policy under its new leadership. Certain segments like small caps (+0.2 percent) and listed real estate (–1.3 percent) did not share in the upside. From a U.S. vantage point, the S&P 500 closed 2.3 percent up. Early-month trade skirmishes rattled markets, but late-month talks revived sentiment. In the U.S., 82 percent of the reporting companies beat earnings expectations, well above the norm. A lot of emphasis was placed on companies ability to continue spending capex in an environment where the return on investment is still debatable. So, while the equity environment is constructive, selective exposure may be wise given the backdrop.

Morgan Stanley estimates that top capex spenders will reach $591bn/$700bn in data centre capex in ’26/’27

Note: aggregate volumes for the following companies: AMZN, GOOGL, META, MSFT, ORCL

Source: BofA Global Research, Bloomberg, Visible Alpha

Fixed Income: Diverging Behaviours

The bond world presented a mixed picture. Emerging-market debt (+2.2%) stood out, benefiting from higher real yields and a softer dollar as many EM central banks had already tightened ahead of this cycle. In the developed world, UK Gilts led on the government side: yields dropped ~30 basis point in October in response to dovish signals from the Bank of England and softer inflation data. Meanwhile, Japanese government bonds lagged, as policy normalisation expectations and concerns about increased supply weighed. For credit, high-yield bonds slightly outperformed investment grade, but spreads widened modestly – another sign of “cautious optimism.”

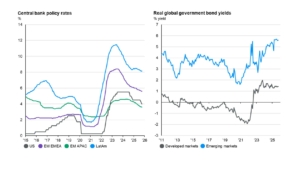

Central bank policy rates heading lower as developed market bonds offering some real value

Source: JP Morgan

Local Focus: Rotation was the story

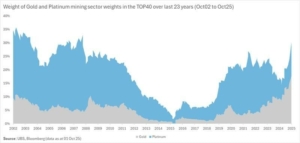

On the SA front, the local market reflected these global dynamics while adding its own flavour. The FTSE/JSE JSE All Share Index rose by approximately 1.6% in October, lifting the year-to-date performance to about +33.9%. Domestically-oriented companies outperformed mining and resource stocks, which had dominated earlier in the year.

For much of 2025 up to end-September, precious metal mining stocks (gold and platinum) were responsible for the lion’s share of returns. But in October those same miners became headwinds: gold-miners fell ~5% for the month and platinum miners ~10%. Meanwhile, companies more tied to the domestic economy rallied about 8%.

Rates, Bonds and the Rand

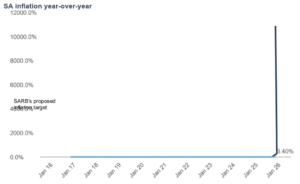

In October 2025, the South African macro backdrop showed encouraging signs of improved stability, which in turn added support to both the rand and domestic interest-rates markets. Inflation held at about 3.3 – 3.4% year-on-year, aligning closely with the lower end of the South African Reserve Bank’s (SARB) target band, and importantly – the SARB confirmed its plans to explicitly shift towards a 3% inflation anchor. Meanwhile, the yield on 10-year South African government bonds eased below 9%, producing attractive real yields that helped the bond market rally. At the same time, the South African rand performed relatively well against the U.S. dollar, with modest monthly weakness despite a firm dollar globally. The rand’s resilience reflects growing investor confidence in South Africa’s policy trajectory, lower inflation expectations and declining sovereign risk premia. The combined effect of a clearer inflation path, falling long yields and a more stable currency, has created a more supportive environment for local assets, both equity and credit, as markets increasingly price in a “lower for longer”-interest rate regime domestically.

Outlook: Subtle Shifts with Implications

Two themes warrant attention. Firstly, inflation in the U.S. surprised to the downside – tariff passthrough has been more contained than feared, and services/rent inflation continues to moderate. This helped the Federal Reserve deliver a 25 basis point rate cut, lowering the target range to 3.75 % – 4.00%, but importantly, Chair Jerome Powell signalled that further cuts aren’t guaranteed at this moment – markets pared back expectations of future easing. Secondly, the late-month warming in U.S.–China trade relations, especially around rare-earth minerals and tariffs, helped equity sentiment. However, the fact that no formal deal was signed still leaves some uncertainty.

October delivered a constructive tone, but it also signalled that markets may be entering a more measured phase. The key question now: can positive factors (tech/AI momentum, softer inflation, improving trade dynamics) continue to meaningfully outperform the risks (policy missteps, inflation flare-ups, geopolitical surprises)?

Major asset class performance (South African Rand)