November 2025 In Review

Valuation concerns on AI-related stocks drove investors to defensive sectors

Global equities experienced elevated volatility in November 2025 as investors reassessed valuations, especially in technology and AI‑linked sectors, against a backdrop of shifting macroeconomic expectations. Defensive sectors generally outperformed, while high‑growth names faced pressure.

Softer economic data from the US, and Japan bond market worries

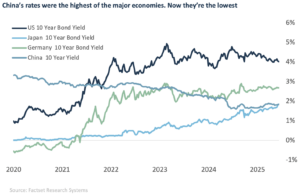

US fixed income delivered modest positive returns in November as yields drifted lower. Softer US economic data resulted in a decline in expected inflation, pushing US yields lower. In contrast to the US, Japanese bond yields rose to their highest levels since 2008. The Bank of Japan is considering increasing interest rates, as inflation has been above the BOJ’s 2% target for 43 straight months, and hence the risk of bond yields spiking further looms large.

Silver playing catch-up to gold

In commodity markets, oil prices declined by 4%, ending the month below $60 per barrel. Natural gas prices jumped 17% to reach a 3-year high as the US recorded a record-high LNG exports, particularly to Europe, which created tighter domestic supply and fueled demand as cold weather approaches. Gold gained another 5%, closing above $4000 per ounce, setting a new all time high. Silver continues to play catch-up to gold, and gained 10% during the month.

South African Bonds shines along side gold mining companies

South Africa’s November market story was shaped by two bright spots: bonds and gold. As the SARB trimmed interest rates, bond yields eased and prices climbed, giving investors a rare mix of strong income and capital uplift. At the same time, rising gold and platinum prices breathed new life into the country’s miners, sending their shares sharply higher. Together, the bond rally and the sparkle from precious-metal stocks set the tone for a month where confidence quietly but noticeably began to build.

Markets Navigate a Cloudy Macro Landscape

November brought a softer tone to the global economy as conflicting data made it harder to judge the true strength of growth. Even the end of the 43-day U.S. government shutdown offered little clarity, with uncertainty around the labour market and the Federal Reserve’s next move weighing on sentiment. U.S. indicators told a mixed story – unemployment and jobless claims rose, consumer confidence slipped, yet payrolls beat expectations – leaving markets unsure of the direction of travel.

Inflation trends also diverged, easing in the UK but rising in Japan. Bond markets echoed this uncertainty: U.S. Treasuries rallied on hopes of a December rate cut, while Japanese and European government bonds lagged amid concerns about inflation and higher borrowing. Overall, the macro picture turned cloudier, reminding investors how quickly policy and growth signals can shift.

Equities Catch Their Breath After a Strong Run

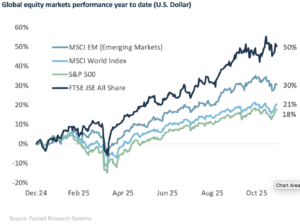

After ten months of strong gains, global equities finally tapped the brakes in November. Developed markets ended the month 0.3% higher despite solid earnings and hopes of a December Fed rate cut.

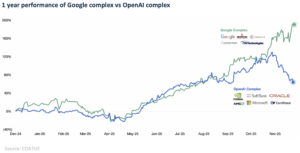

What really stood out was a sharp change in leadership. Defensive sectors suddenly took the spotlight, while technology and other cyclical areas struggled. Even excellent results from NVIDIA couldn’t silence worries about stretched valuations and overly optimistic expectations around AI. Technology became the worst-performing sector, pulling growth stocks lower and leaving them trailing value by more than 3.5%. Tech-heavy markets like Korea and Taiwan saw the biggest pullbacks, driving emerging markets to underperform developed markets. It was a clear reminder that when valuations get lofty, market leadership can shift quickly. The shift within the AI space was striking, with markets suddenly anointing Alphabet (Google) as the new frontrunner in the race.

Fixed Income’s Quiet Surface With Plenty Moving Underneath

Global bonds were broadly flat, returning about 0.2%, reflecting an environment in which supportive and negative forces balanced one another out. Weaker U.S. labour and consumer confidence data helped anchor yields, while concerns about higher future supply nudged them higher. U.S. Treasuries ended up being the standout performer, rising 0.6% as yields drifted lower.

Elsewhere, the picture was less comforting. Japanese government bonds fell 1.3% amid rising doubts over the sustainability of Japan’s ultra-accommodative policy mix and growing inflation concerns. UK gilts were essentially flat, held back by pre-Budget uncertainty despite later relief from reduced supply expectations. German Bunds also lagged as borrowing needs exceeded projections. Inflation-linked bonds offered only mild gains as global inflation dynamics and duration risks offset one another.

JSE still a star performer

November read like another strong chapter in South Africa’s market revival. While global markets moved with caution, the JSE pushed ahead, lifting 2.3% for the month and ranking among the world’s top performers – second only to Brazil. In US dollar terms, the FTSE/JSE Capped SWIX Index is now up an impressive 51% for the year.

The momentum was driven largely by a renewed surge in precious metals. Gold and platinum prices jumped about 6% in November, propelling their miners nearly 13% higher and reinforcing their role as the JSE’s standout performers in 2025. With both metals up more than 60% and 80% respectively year-to-date, their strength continues to anchor market sentiment. But the month also had its contrasts.

Naspers and Prosus, usually heavyweight contributors, lagged sharply – down 12% and 10%. Despite delivering solid earnings, the market reacted nervously to uncertainty around future buybacks and reluctance to sell more of their major offshore holding to fund them.

SARB Signals Confidence as the Rand Joins the Recovery

November also brought a turning point on the interest-rate front. The South African Reserve Bank trimmed the repo rate by 25 basis points to 6.75%, pulling the prime lending rate down to 10.25%. The move signalled growing confidence that inflation is finally settling, and it offered some welcome breathing room to households and businesses after a long stretch of elevated borrowing costs.

Bond markets responded almost immediately. With rates moving lower and the economic outlook improving, fixed-income investors saw both stronger price support and attractive yields – a combination that has made bonds an increasingly appealing part of balanced portfolios this year.

The rand added to the positive tone, firming slightly against the US dollar through the month. A steadier, stronger currency helps keep imported inflation in check and reinforces broader market confidence, especially when paired with more supportive monetary and fiscal signals.