Skip to content

Marketing Report: May 2025 in Review

May 2025 In Review

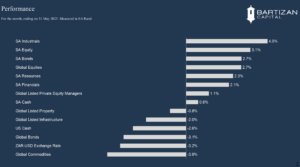

Global investment markets rebounded sharply in May (measured in US dollars), buoyed by improved consumer sentiment, strong corporate earnings, and an easing in global trade tensions, most notably, the partial rollback of tariffs announced on Liberation Day. These developments helped calm recession fears and sparked a broad rotation back into risk assets. Global equities led the charge. Developed markets rose 6.0%, with US stocks outperforming. The S&P 500 gained 6.3% in a rally that extended beyond tech into cyclical sectors like industrials and consumer discretionary. Small caps also rebounded (+5.9%), fueled by optimism around tax and regulatory changes aimed at smaller US businesses. Bond markets remained volatile.

The Bloomberg Global Aggregate Bond Index declined 0.4%, dragged down by sticky inflation, growth concerns, and growing fiscal risks. A mid-month sell-off followed Moody’s downgrade of the US sovereign credit rating, pushing longer-dated yields higher. Markets across the US, UK, and Japan underperformed, while Spain and Italy proved more resilient thanks to improving fiscal positions. Commodities, however, underperformed.

The Bloomberg Commodities Index fell 0.6%, with gold down 0.8% as risk appetite returned. Industrial metals (+1.2%) and energy (+0.5%) made modest gains. Oil dipped to $60 per barrel mid-month before recovering to nearly $63, with traders closely watching OPEC+1’s next move.

The Dollar declined against the SA Rand, due to growth concerns in the States. This resulted in a negative impact on South African investors’ offshore investments. The South African industrial sector was once again the best-performing asset class during May, driven by Naspers, Prosus, and Richemont.

Page load link