Skip to content

Marketing Report: May 2024 in Review

May 2024 In Review

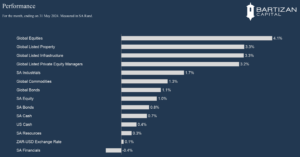

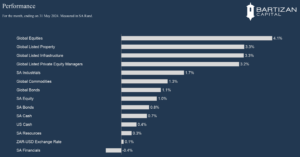

After the pullback in April, the global equity market posted a strong recovery in May. The market performance during May was driven by an increase in earnings expectations and higher valuations, although valuations did start to fall back during the last week of the month. The performance of technology and utility companies overshadowed the rest of the market. Interest rate-sensitive industries, like listed infrastructure and listed property, also posted strong gains, an indication of equity investors expecting lower interest rates to benefit these industries.

The US Treasury market experienced volatility, as shortages of buyers at debt auctions raised concerns, leading to fluctuations in yields over the month. Both the US 10-year and 2-year government bond yields ended the month slightly lower.

Crude oil prices were down 7% for the month, with the bulk of the decline occurring at the start of the month, and thereafter the oil price fluctuated due to supply chain bottlenecks and geopolitical events. Precious metals, like gold and silver, continued to experience an increased demand, as investors sought safe-haven assets.

The local equity market lagged its global peers, driven lower by a 3.8% decline in Anglo American after mining rival, BHP Group, announced it would retract its firm offer for Anglo American. Sasol was down by 6.9% on the back of weaker oil prices. MTN was another company that struggled during the month, its share price declining by more than 9%, pushing its price down by a third over the past 12 months.

Page load link