Skip to content

Marketing Report: March 2024 in Review

March 2024 In Review

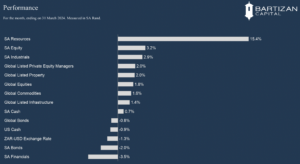

US Treasury 10-year yields hit a four-month high during February, driven by both firmer growth and stickier inflation signals from manufacturing data released during the month. US inflation remains the key focus point for investors, as a resilient US economy is creating worries under investors that the US Federal Reserve won’t ease interest rates in 2024. Against this backdrop, offshore and local bonds delivered negative returns for the month. Despite the uncertainty around the interest rate outlook, global equities delivered positive Dollar returns for the 5th consecutive month as the market’s outlook for earnings growth continues to improve.

The Rand appreciated by 1.3% against the US Dollar, resulting in lower Rand returns on offshore assets for local investors.

The Rand prices for gold and palladium prices shot up by 6% during the month. As a result, we witnessed strong price movement in AngloGold (+17%), Goldfields (+20%) and Implats (+21%), and the overall local resource sector delivered the best performance across the asset classes we monitor for the month. The South African equity market ended the month +3.2% higher.

Page load link