Skip to content

Marketing Report: June 2025 in Review

June 2025 In Review

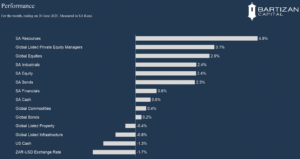

June saw a strong rebound across global equity markets, driven by the Information Technology & Telecommunication sectors. Performance was supported by easing trade tensions between the US and China and resilient corporate earnings, especially from US technology companies. Global bonds also experienced a positive return (in US Dollars) for June. In the fixed income markets, corporate and non-investment grade debt outperformed broad government debt.

Global investors continued to shift money into euros, yen, and gold, seeking safer havens amid ongoing US policy unpredictability. As a result, the U.S. dollar weakened sharply, down 2.5% for the month against major trading partners. Oil and gas prices rallied during June due to the conflict in Iran. Precious metals like gold and silver continued their rise due to concerns about higher US inflation (fueled on by President Trump’s proposed “One Big Beautiful Bill”) and a further weakening of the US Dollar.

SA Resource sector was the top-performing sector for the month, as gold and platinum mining companies surged on the back of stronger precious metal prices.

Page load link