Skip to content

Marketing Report: June 2024 in Review

June 2024 In Review

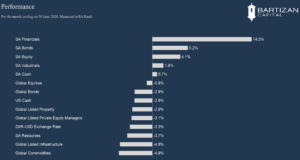

Global equities advanced by 2.2% in U.S. Dollar terms during the month of June, led by a handful of large technology companies. Apple, Google, Microsoft and Nvidia are all up by more than 5% in US Dollar terms for the month. Equity sectors that are typically considered more defensive, all reported negative returns for the month, with Materials (-3.5%), Utilities (-4.2%) and Industrials (-1.7%) recording the biggest declines.

The US 10-year Treasury Bond started the month at a yield of 4.49%, then declined to 4.21% midway through the month, and then retraced back to end the month at 4.37%.

Looking at the price movements on global equity markets and the US fixed income market during the month, we conclude that investors are increasingly uncertain about the short-term outlook, and whether the US Federal Reserve will cut interest rates this year. It remains a tug-of-war between valuations and earnings growth.

Local equity and bonds market rallied on positive sentiment from the formation of a Government of National Unity. Local financials and retailers were the star performers for the month, with Capitec (+23.4%) and Discovery (+22.8%) leading the financials and Truworths (+22.3%) and Foschini (+34.2%) leading the local retailers.

Page load link