Skip to content

Marketing Report: July 2025 in Review

July 2025 In Review

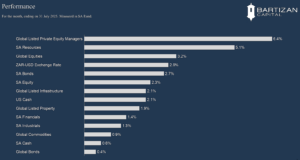

A burst of trade deals from the Trump administration plus the passage of the crowd-pleasing One Big Beautiful Bill Act (OBBBA), helped markets breathe easier in the month of July. While tariffs remain well above pre-Trump norms (15%-20%), the deals helped take some of the heat out of trade war fears. Markets didn’t exactly throw a party, but they appreciated the fact that chaos didn’t escalate. Global developed market equities gained 1.3% in US Dollars, hitting new highs. Early in the month, investors favoured small caps, boosted by OBBBA’s growth-friendly tweaks. But strong big-tech earnings and a steady Fed handed the baton back to large caps late in the month. Cyclical sectors led, and growth stocks (+2.1%) outpaced value (-0.6%). Emerging markets (+2.0%) outperformed, with strength out of China, Korea, and AI-amped Taiwan. Commodities were mixed: gold took a breather, copper dipped after Trump slapped a 50% tariff (then walked it back for refined metals), and iron ore rallied. With valuations now lofty (global equities at 20x next year’s earnings), markets are betting big on a Goldilocks mix of growth, AI, and tame inflation.

Global bond markets struggled under the weight of rising yields and a strong dollar, with the global aggregate index down 1.5% in U.S. dollars.

Local resource was once again one of the better-performing sectors of the market, with GoldFields and Sibanye being the two largest contributors for the month.

Page load link