Skip to content

Marketing Report: January 2025 in Review

January 2025 In Review

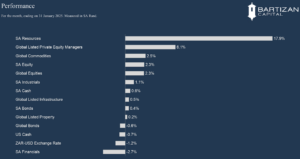

In January, financial markets were driven by technological disruption from China and policy transitions out of Washington. A reported AI breakthrough by the Chinese company DeepSeek led to declines in some technology stocks, notably Nvidia. DeepSeek has purportedly built cutting-edge models that require 95% fewer resources to train than those created by OpenAI and other leading companies.

The possibility that the tech industry requires far fewer computing resources and energy has rippled across financial markets. Another important development is in Washington, where the Trump administration implemented new tariffs, including a 10% tariff on China and a 25% tariff on Canada. A 25% tariff on goods from Mexico has been paused for a month after reaching a deal with the Mexican president. Economists project these measures could have economic implications for consumers and businesses, including the possibility of higher inflation. Finally, the US Federal Reserve decided to keep rates steady at 4.25 to 4.50% at its January meeting. This represents a pause in rate cuts after it lowered rates at the previous three meetings. The Fed made this decision because the economy is growing steadily, the job market is strong, and inflation remains stubborn.

Recent data shows that inflation accelerated slightly on a year-over-year basis due to factors such as energy costs. Long-term interest rates have remained elevated as well, which suggests that investors also believe that monetary policy will need to remain restrictive for an extended period to ensure price stability. Gold increased 7.8% (US Dollar terms) as global trade tensions escalated, and on the local Johannesburg Stock Exchange, gold companies AngloGold and GoldFields’ share prices jump by more than 30%, supporting the SA Resource sector’s performance for the month. After enjoying strong gains in 2024, local banks declined by around 2.7% during January.

Page load link