Skip to content

Marketing Report: December 2024 in Review

December 2024 In Review

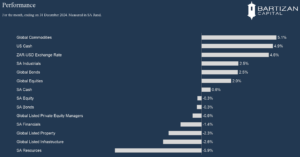

Global stocks fell in December, with broad-based weakness across all regions, as the US Federal Reserve unveiled hawkish-looking interest rate projections for 2025. The US Federal Reserve reduced its target rate to the 4.25-4.50% region and suggested only two further rate cuts in 2025 in their quarterly projections (reduced from four). As a result, 10-year yields rose across the US and Europe, hurting their performance for December. In commodities, oil and gas prices edged higher in December. For the year, oil is below its starting price for the year, whereas natural gas prices increased by more than 50% for 2024. The revised US interest rate outlook also pushed the US dollar to an all-time high on a nominal trade-weighted basis. On the back of the stronger Dollar, the South African Rand depreciated by 4.6% during December. The weaker Rand supported local investors’ offshore investments in Cash, Bonds, Commodities and Equities.

Local Cash and Industrial shares were the only two local asset classes that reported positive returns for December, with Richemont, Tiger Brands and MTN the three standout performers for the month. SA Resources were negatively impacted by a decline in precious metal prices. Global Property and Global Listed Infrastructure also reported negative returns (in SA Rand), as these two asset classes are more sensitive to interest rates, and the revised outlook for further rate cuts is viewed as unfavorable for these assets.

Page load link