Skip to content

Marketing Report: April 2025 in Review

April 2025 In Review

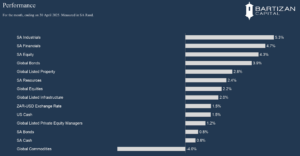

April 2025 was a volatile yet resilient month for global equity markets, shaped once again by geopolitical tensions & trade policy shifts. Early losses in April were driven by concerns over trade wars and slowing economic growth, with global markets shedding nearly $9 trillion in value before rebounding towards the end of the month. Consumer staples outperformed, while energy and discretionary sectors lagged. Regional divergence was notable: Latin America and India led gains (+2.1% and +1.8%), while China was the worst performer (-3.7%). In the fixed income market, bond yields declined as investors priced in slower global growth and potential rate cuts by central banks. US Treasuries saw a bull steepener, with short-term yields falling more than long-term yields, signaling expectations of economic slowdown. Emerging market debt faced volatility due to trade policy uncertainty and currency fluctuations. Investment-grade credit spreads widened, reflecting cautious sentiment in corporate debt markets.

Gold prices soared to an all-time high of $3,500 per ounce, the rally was driven by geopolitical tensions, trade war concerns, and central bank purchases. Oil prices plummeted, marking their worst April performance on record. Brent crude fell 14%, dipping below $64 per barrel, while WTI hovered near $60 per barrel. The decline was fueled by trade war fears, rising crude stockpiles, and OPEC+ loosening output curbs. US crude inventories rose by 3.8 million barrels, adding to bearish sentiment.

South African Equity was the best-performing asset class during April, driven by industrial shares (Naspers, British American Tobacco, Woolworths, Clicks and Vodacom).

Page load link