Economic and Market Overview

September 2022

Global

The last 15 years represent a truly remarkable time in the global economy and markets.

From the Bear Sterns leverage credit hedge funds collapse in 2007 to the war in Ukraine, the last decade and a half has truly tested the resilience of investors. As Mark Twain said, history does not repeat itself, but it often rhymes. In a recent conference, Goldman Sachs highlighted five key themes reshaping economic and investment cycles. These are deglobalisation, the move to net zero carbon emissions, changes in demographics, digitisation, and geopolitics.

In their view, a partial reversal in globalisation is likely to structurally boost inflation. The contribution to global GDP of goods traded across borders has more than halved over the last decade and the flow of capital and labour between countries has also slowed. These trends are likely to have a slowing impact on what the Austrian economist Joseph Schumpeter calls “disruptive innovation” – a phenomenon which has helped lower global inflation over the last two decades.

over the last decade and the flow of capital and labour between countries has also slowed. These trends are likely to have a slowing impact on what the Austrian economist Joseph Schumpeter calls “disruptive innovation” – a phenomenon which has helped lower global inflation over the last two decades.

Decarbonisation will lead to the invention of new industries and the creation of so-called “green-collar” jobs. The difference between current annual investment in green projects and business will likely double from a little over USD 3 trillion to around USD 6 trillion in the next decade. It’s a trend that investors ignore at their own peril. This required increase in investment is roughly equal to the size of the United Kingdom’s annual economic output – the 5th biggest economy in the world.

An aging global population is another trend that will play an important role in investment outcomes over the next few decades. The workforce as a proportion of the total population is shrinking as birth rates drop and mortality increases. Workforce participation, however, will also change as more flexible working arrangements post the Covid-19 pandemic becomes the norm. In the words of Erik Brynjolfsson (Director of the Stanford Digital Economy Lab): “The pandemic compressed about 20 years of change into 20 weeks, marking the biggest shift in the way people work since World War II.”

Destabilisation in geopolitics will likely lead to more persistent supply issues for key commodities – from gas to copper, to the lithium required for a battery-operated world. This may have key consequences for the continued move to digitisation. The infrastructure development required for an ever more digitised world depends on the availability of a variety of commodities. From a global macro-economic and investment angle, these key trends are worth considering when investors consider their capital allocations over the next few decades.

South Africa

Inflation reached a new high in South Africa but is still lower than many developed and other emerging market countries.

Visio Capital reports that headline year-on-year inflation for July increased to 7.8% from 7.4% in June. The transport and food categories continue to be the main contributors making up 3.7% and 1.8% of headline inflation, respectively. The price of fuel alone, despite only making up 4.6% of the inflation basket, made up 2.6% of the headline number. Therefore, given the decline in the price of fuel by almost 5% in August, and a possible similar fall in September, headline inflation has likely peaked in July and should trend lower over the next two years.

The speed of moderation in headline inflation could be somewhat slowed down as core inflation trends higher due to further increases in the housing category (owners’ equivalent rent) and administered prices (electricity and water). Nonetheless, inflation is expected to re-enter the target range during the second quarter of 2023.

The South African economy has probably contracted by more than what the market expected a month or so ago. The expectation was for a contraction of 1%, but the manufacturing (down 5.5%), and wholesale trade (down 5.6%) sectors recorded their worst quarter in over a decade outside of the COVID-19 lockdown lows. The mining sector also contracted (down 3.3%), being affected by energy shortages, as was evidenced by the fourth consecutive month of declining electricity output in June. While the remainder of the year is likely to record some recovery, high energy costs, higher policy rates, and slowing global economic growth are likely to remain as headwinds for the next few quarters.

Structural constraints remain an obstacle to faster recovery and job creation, limiting SA’s potential economic growth with knock-on inflation and fiscal implications. Encouragingly, Operation Vulindlela (meaning ‘to open the way’), the Presidency’s initiative “to fast-track delivery of economic reforms”, looks to be attracting more attention and showing better progress, and should facilitate more investment and growth in the medium term. It’s a process that’s taking far longer than it should, but it’s moving in the right direction.

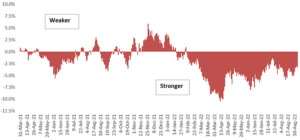

According to the Analytics Currency Decoder, fair value for the rand is now almost R18 to the US Dollar. At current levels it implies that the rand is stronger than was expected:

ZAR/USD relative to estimated fair value

Source: Dr Lance Vogel, Analytics

Market Performance

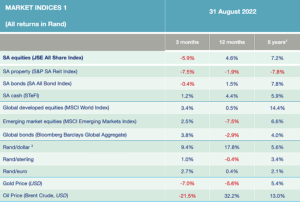

Following the relief rally of July, investors were brought back down to earth again with a bump in late August.

According to Laurium Capital’s monthly market commentary, this market volatility is symptomatic of the highly uncertain economic outlook facing investors and policymakers. Monetary policy focus shifted to the Federal Reserve Governor Powell’s speech at the Jackson Hole conference wherein he spoke mostly about ongoing inflation pressures, without placing much emphasis on the bleak outlook for global growth. This hawkish tone from Fed members as well as the ongoing crisis in European energy/gas markets, reignited fears for a hard economic landing ahead and pushed bond yields higher once again. There was not much good news to factor in, although recession fears did put pressure on the price of crude oil, which weakened to below $100 for Brent crude.

The MSCI World Index returned -4.3% in US dollars, with most global indices tracking lower. South African equities performed slightly better than the average market, buoyed by a positive monthly return for Naspers, and flattered by the weaker Rand. The overall JSE All Share Index fell 1.8% for the month in ZAR. The Rand had a bumpy month against the backdrop of a rampant greenback, ending the month at R17.17, having traded as low as R16.17 per US dollar intramonth.

South African government bonds experienced a month of two halves – initially rallying into the middle of the month on stronger global risk appetite, and then following developed market yields higher into month end and essentially ended the month flat. Gold (-2.8%) and Platinum (-6.6%) both pulled back when measured in US dollars.

- Source: Factset

- All performance numbers in excess of 12 months are annualised

- A negative number means fewer rands are being paid per US dollar, so it implies a strengthening of the rand.

Commentary: Rent or buy?

As interest rates are increasing around the globe and landlords are under pressure to protect occupancy levels, it’s not surprising that the debate of rent versus buy enjoys attention again. This is true for corporate, retail and industrial property, but particularly relevant to many investors, would be the question whether it’s better to own the property you live in, rather than paying monthly rent to a landlord.

For many it’s not a debate at all. The immediate rhetoric of many homeowners on being questioned why they are not renting is “why would I pay off someone else’s bond if I can do that for myself?” It’s a good question to ask, but the answer(s) may yet be a bit more complex than what meets the eye.

There are various factors that need to be considered when contemplating rent versus ownership. We cover a few:

Monthly cash flow

The monthly bond payment is often directly compared with monthly rent. Before the most recent interest rate increases, this may have been very favourable for homeowners versus tenants. It’s however important to remember that a tenant only pays rent and is not responsible for the upkeep of the property, its municipal taxes, insurance of the structure and other costs such as estate/complex levies. Rent increases annually whereas bond payments vary with interest rate movements. Whether utilities such as water and electricity are included in the rental payment will also make a material difference when monthly cash flow of the two options are pitted against each other.

Interest and inflation rates

These two factors make a big difference when monthly cash flows are compared over a period of two decades (the typical term of a home loan). Interest rates influence home loan repayments, whereas inflation is often taken into account for annual rent increases. It’s near impossible to accurately forecast either of these variables twenty years out but it would be sensible to, at the very least, consider the influence on your monthly budget under various low and high inflation and interest rate scenarios.

Investment growth

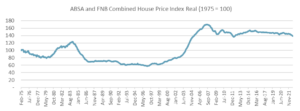

Lastly, many homeowners cite the protection their asset provides against inflation as a reason for ownership. Renters, on the other hand, argue that their monthly rent is lower than the monthly cash flow required to own a home and that the residual amount, if invested in the stock market or a multi-asset investment fund, builds a nest egg that will eventually allow them to buy a house cash. Both arguments are very dependent on the growth in either asset (property versus equities). As the combined ABSA/FNB Home Price Index (in real terms) shows South African house prices showed significant growth in excess of inflation between 1997 and 2007. Prior to that golden period, and for the 15 subsequent years, owning a home did, however, not protect investors against inflation, and this may come as a surprise to many. In short (and leaving emotional factors aside) it’s not always clear that ownership trumps rent.