Economic and market overview

Global

Socio-political news flow was dominated by the United States and allied forces’ chaotic withdrawal from Afghanistan during August.

While the move to withdraw was the result of long-dated US policy intentions formed under former President Trump, making the final decision fell to President Biden and opened him up to sharp criticism and renewed doubts over US foreign policy endurance. China and Russia were conspicuous in their silence as the Taliban gained control of most of the country in much shorter order than expected.

In their monthly market commentary, Laurium Capital reported that all (economic) eyes were on the Jackson Hole meeting address by US Federal Reserve Governor Powell. He delivered a studiously ambiguous analysis, hinting at the tapering of bond purchases by the end of this year whilst simultaneously pouring cold water on expectations of imminent interest rate hikes. As a result, the market response (across currencies, bonds, and equities) was muted but generally positive.

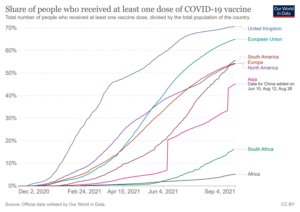

The rapid spread of the Delta variant of the coronavirus and subsequent impact on economic activity around the world also caused worries for investors. Developed markets generally seem to weather the storm much better, benefiting from policy stimulus and faster opening of economies due to a more effective vaccine rollout compared with emerging markets as indicated by the graph below. Among developing markets China and South America are leading the pack by some margin, with South Africa making slow but steady progress:

South Africa

President Ramaphosa announced a long-awaited reshuffle of his cabinet. This saw finance minister Tito Mboweni being replaced by Enoch Godongwana.

Godongwana is a seasoned ANC politician who cut his teeth in the labour union movement. He is regarded as a pragmatic economic voice and a trusted pair of hands who is likely to persist with the current fiscal and economic development path set by the outgoing Mboweni. He has a master’s degree in financial economics and in his tenure as chairperson of the ANC’s economic committee he gave voice to the more centrist views in the ruling party. He is also well known to the incumbent National Treasury team which is a key positive in this development.

StatsSA completed its GDP benchmarking review to align with international best practices. The result of this alignment was the upward revision of the size of the SA economy by 11%, with the 2020 GDP contraction reduced to -6.4% versus the prior statistic of -7.0%. This upward revision in size will optically improve various ratios such as debt to GDP (via a larger denominator), thereby improving our economic standing relative to peers. Unfortunately, from a high-level perspective, this does not improve the trend in fiscal deterioration seen in recent years, and therefore will likely have little impact on fiscal policy. It also does not change the number of unemployed people in South Africa which, alongside the state of our education system, poses the biggest risks to long-term economic growth in this country.

alignment was the upward revision of the size of the SA economy by 11%, with the 2020 GDP contraction reduced to -6.4% versus the prior statistic of -7.0%. This upward revision in size will optically improve various ratios such as debt to GDP (via a larger denominator), thereby improving our economic standing relative to peers. Unfortunately, from a high-level perspective, this does not improve the trend in fiscal deterioration seen in recent years, and therefore will likely have little impact on fiscal policy. It also does not change the number of unemployed people in South Africa which, alongside the state of our education system, poses the biggest risks to long-term economic growth in this country.

Headline inflation for July (4.6%) slowed for the second consecutive month. In their monthly market and economic commentary Visio Capital notes that despite material increases in global inflation as both supply chain disruptions leads to cost-push and vaccine roll-out results in demand-pull inflation, SA’s inflation remains relatively muted as pricing power remains weak. Furthermore, while domestic food inflation has risen to its highest level in over 4 years, it has been relatively subdued compared with global food prices.

Apart from stable (and low against historical standards) inflation, there is another silver lining to the dark cloud that is the South African economy. In a recent webinar Kevin Lings, chief economist of STANLIB, said the following in the context of the very large trade surplus (in excess of R50 billion, see graph below) that South Africa has enjoyed in recent months: “…the context is we have had nothing like this in our history, we haven’t even come close to this size of trade surplus. This dwarfs anything we have had previously, so there is no doubt this is not beneficial and has been a big factor in supporting the currency, which we know is under pressure right now – imagine what the currency would have done if there had not been this spectacular trade surplus.”

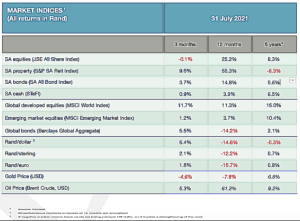

Market Performance

Global markets continued their upward push in August. Emerging markets (including South Africa) underperformed global developed markets as further weakness in Chinese equities weighed on returns in developing countries.

Laurium Capital reported that the Chinese regulatory authorities continued their quest to rein in the powerful technology entrepreneurs and platforms, especially those sharing data with the USA, and those that seek to commercially exploit the thirst for improved education and healthcare amongst the working class in China. Effects of Chinese policy action also spilled over into the commodity sector where ongoing restrictions on steel exports finally weighed on the rampant iron ore price, bringing it closer to sustainable levels.

The FTSE JSE All Share Index (with its heavy Naspers weighting) lost -1.7% in value. Financials bucked the trend of the broad local market returning 10.5% in August. Resources shares fell in sympathy with the pullback in base metal prices despite strong earnings reports. Amongst industrials, domestic shares were firm but the Industrial Index return of +1.9% was negatively affected by Naspers and Prosus which declined significantly. This period marked the conclusion of the controversial Naspers/Prosus share swap-over, which ended up being widely accepted by shareholders.

The rand, after much intra-month volatility where it traded at a high of R14.22/$ and low of R15.39/$, ended broadly unchanged for the ending 31 August 2021.

Commentary – Lies, damned lies, and statistics

It’s not quite clear who first said that “there are three degrees of untruth – lies, damned lies, and statistics” but that does not take away from its universal truth. When one researches the origins of this profound statement you are likely to also come across this gem of a quote: “A well-known lawyer, now a judge, once grouped witnesses into three classes: simple liars, damned liars, and experts.” It’s against this background that it may be useful to provide a bit more context to the recent upwards revision of 11% to the size of South Africa’s economy, taking it to R5,5 trillion.

Statistics South Africa recently finalised a comprehensive overview of the measurement of its national accounts. The latest gross domestic product (GDP) rebasing and benchmarking exercise has resulted in an upward revision in the size of the economy, as well as changes to the composition of the supply and demand sides of economic activity.

It’s important to note that there was no political malice in the recalculation of the national accounts. Any statistical agency worth its salt should periodically revisit the way in which it measures the economy. Economies are dynamic, shifting and changing over time. New industries rise to dominance while others fade away, consumer tastes wax and wane, and new technologies replace the old. Rebasing and benchmarking exercises ensure that the tools used to measure the economy take these changes into account.

It’s important to note that the level of South Africa’s economic activity has not changed. What has changed is the way in which it’s being measured. Essentially the catch-net for data has improved and more information is taken into account when GDP is calculated. This means that certain economic activities (some of which have existed for a very long time) are now “seen” when the economy is viewed through a statistical lens. They were always there but just not included in the numbers.

account when GDP is calculated. This means that certain economic activities (some of which have existed for a very long time) are now “seen” when the economy is viewed through a statistical lens. They were always there but just not included in the numbers.

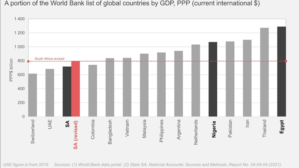

Despite the revision, South Africa remains the third-largest economy on the continent after Egypt and Nigeria:

Commentary – Lies, damned lies, and statistics (continued)

Analysts at Capital Economics warned that while the upward revisions would soothe South Africa’s debt and deficit ratios, the structure of the economy remained a concern and the underlying debt dynamics remained a serious headwind.

“The revisions imply a budget deficit of around 10% of GDP in the fiscal year 2020/21, compared to 11% under the previous GDP series, and public debt at 71% of GDP over the same period, compared to 79%, said Virág Fórizs, Africa analyst at Capital Economics. “GDP rebasing does, however, not remove key headwinds facing the recovery, such as the government’s austerity plans, power cuts, and any lasting economic damage from the pandemic or recent unrest,” Fórizs added.

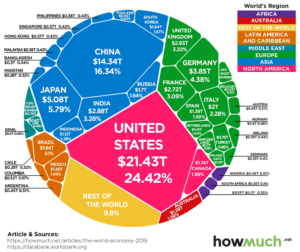

One of the key questions remaining is what this rebasing means for South African investors. At USD 350 billion the South African economy may hold its own on the continent, but in a global context it pales in comparison when viewed against the world’s GDP of USD 88 trillion:

viewed against the world’s GDP of USD 88 trillion:

What will matter for South Africa is not so much how the economy is measured at any point in time, but the rate at which it grows. It’s real economic growth (and not statistical wizardry) that this country so desperately needs.