September 2023 In Review

-

The Monetary Policy Committee of the South African Reserve Bank decided to leave the repo rate unchanged at 8.25% (and the prime rate at 11.75%) for the second meeting in a row. The governor, Lesetja Kganyago, highlighted a few risks to growth outlook for our local economy. Despite considerable reprieve in the winter months, South Africa’s electricity loadshedding has increased and prices for commodity exports continue to weaken. In the near term, stronger El Niño conditions threaten the agricultural outlook, while global climatic events present additional risks. Energy and logistical constraints remain binding on the growth outlook, limiting economic activity and increasing costs.

-

Investment in green energy technologies is on the rise and analysts estimate this at between USD 700 billion and USD 1.3 trillion per annum. It is however nowhere near the USD 4 to 7 trillion required to remain on a path to net zero carbon emissions by 2050. To put this annual investment in perspective: the world’s annual economic activity (as measured by total Gross Domestic Product) is around USD 100 trillion. It means that an estimated 4% to 7% of the value of goods and services produced every year needs to be channeled to the pursuit of greener energy production.

-

Against this background, investment in the exploration for oil and gas has slowed down. This will likely put upward pressure on the cost of energy in years to come, as the transition to green energy is likely to be more expensive and slower than anticipated. This year the oil price has risen by nearly 11% which has contributed to headline inflation remaining stickier than expected.

-

Early in October, the United States Congress entered unchartered waters. In a historic vote, they removed Kevin McCarthy as Speaker of the House of Representatives. A right-wing revolt in his own party orchestrated this move following a short-term spending deal McCarthy struck with the Democrats to avert a government shutdown. This may yet have far-reaching consequences – in particular on the US Debt ceiling which looms again in less than 40 days’ time, which may lead to spending cuts in the US Government and an impact on the aid provided to Ukraine by the United States. While Patrick McHenry has immediately been appointed as interim Speaker, he does not have the authority to bring legislation to the House of Representatives – that can only be done once a new Speaker has been elected. This impasse could have a significant impact on market volatility in weeks to come.

-

The World Meteorological Organization (WMO) reported that this September was the hottest one ever and 2023 is firmly set to be the warmest year on record. They added that this continues an extended streak of extraordinary land and sea-surface temperatures and is an ominous signal about the speed with which greenhouse gases are changing the climate.

Market Performance

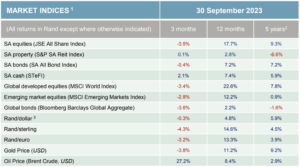

Expensive equity valuations (as share prices outpaced growth in earnings), central banks seemingly still some way off rate cuts, and signs of slower-than-anticipated global economic growth most likely contributed to a pullback in equity markets around the world in September. Global developed equities retreated by 4.3% while emerging markets gave up 2.6% (all in US dollars). Visio Capital reports that sticky inflation and an increasing likelihood of policy rates being “higher for longer”, resulted in a sell-off in government bonds – the US 10-year treasury traded at its highest rate in 17 years.

Local equities (down 2.5%) were not spared despite the bounce back of the resources sector after a poor August. South African bonds sold off with the yield on the 10-year bond increasing by 0.66%. This was on the back of a rise in global bond yields as well as South African-specific risk given our worsening fiscal outlook and took the broad local bond index 2.4% lower.

Gold (down 4.6% in US Dollars) and Brent Crude Oil (up 9.7%) made big moves during the month. The continued rise in the oil price will hinder the downward movement of global inflation, as energy prices comprise a significant part of headline inflation.

- Source: Factset

- All performance numbers in excess of 12 months are annualised

- A negative number means fewer rands are being paid per US dollar, so it implies a strengthening of the rand.

Did you know?

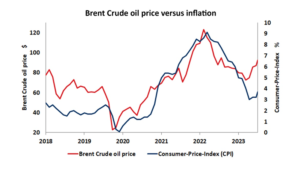

This chart compares the trends in the US Consumer Price Index (CPI) and Brent Crude oil’s price per barrel over the past five years. The price of Brent Crude oil is one of the major benchmarks used to set global oil prices. This is important to follow as it influences energy prices and in turn production and transportation costs, ultimately contributing to inflationary pressures. This relationship is demonstrated by the correlation between the Brent Crude oil price and CPI depicted in the chart. Following an announcement from both Saudi Arabia and Russia, detailing significant voluntary production cuts until the end of the year, prices broke through $90 for the first time in 2023. This is also a consequence of record-high global oil demand driven by strong summer air travel and surging Chinese petrochemical activity, with world average fuel use reaching 103 million barrels per day in June. This not only has potential damaging economic implications as central banks continue to grapple with high inflation, but also political implications with US elections looming.

With central banks having signaled they may be near the end of rate hike cycles, the risk of rising energy prices causing a reversal of the downtrend in headline inflation may force banks to take more aggressive action than investors expect. This has already been shown this week in the US, where year-on-year CPI rose to 3.7%, higher than investor’s expectations. If interest rates remain higher for longer and discretionary spending decreases as a result of consumers facing higher costs on energy bills and fuel prices, the chances of a recession will increase. As US presidential elections near, the cost of fuel at the pump is likely to have an impact on how voters judge the state of the economy and is an easy way for Republicans to point to Biden’s administration as a cause of this additional financial burden on consumers. High Crude oil prices crashing the global economy is also not in the best interests of Saudi Arabia, who would suffer from a major contraction in demand for an export they rely so heavily on. Therefore, it is unlikely production cuts will continue into 2024 to prevent prices reaching triple digits. Furthermore, China is the largest importer of crude oil globally and therefore, their demand significantly influences oil market dynamics and prices. If growth in the country continues to disappoint, this could also help keep prices from escalating. Given the recent surge in Brent Crude oil prices, it is crucial to closely monitor this commodity’s value, particularly having seen its potential to trigger unsustainable inflationary pressures on a global scale in 2023. This is particularly important as central banks approach a pivotal moment where they must make decisions about potentially reversing interest rate policies.

Source: Momentum Global Investment Management, Bloomberg Finance L.P. Data to 13 September 2023

Disclaimer

For internal use only. The information provided is of a general nature only and does not take into account investor’s objectives, financial situations or needs. The information does not constitute financial product advice and it should not be used, relied upon or treated as a substitute for specific, professional advice. It is, therefore, recommended that investors obtain the appropriate legal, tax, investment and/or other professional advice and formulate an investment strategy that would suit the investor’s risk profile prior to acting on such information and to consider whether any recommendation is appropriate considering the investor’s own objectives and particular needs. Although the information provided and statements of fact are obtained from sources that Analytics Consulting considers reliable, we do not guarantee their accuracy, completeness or currency and any such information may be incomplete or condensed. No guarantee of investment performance should be inferred from any of the information contained in this document. Collective Investment Schemes in Securities (“CIS”) are generally medium- to long-term investments. The value of participatory interests may go down as well as up and past performance is not necessarily a guide to future performance.

Any opinions, statements and information made available, whether written, oral or implied are expressed in good faith. Views are subject to change, without prior notice, on the basis of additional or new research, new facts or developments. All data is in base currency terms unless otherwise indicated, and sourced as disclosed.

Financial Services Providers: Portfolio Analytics Consulting (Pty) Ltd; FSP No 18490 and Analytics Consulting 1 (Pty) Ltd; FSP No 47564; Tel: (021) 936 9500; Website: www.analyticsconsulting.co.za