Skip to content

Economic and Market Overview – October 2022

Economic and Market Overview

October 2022

September In Review

- Central banks around the world continued to push their official rates higher in an attempt to curb inflation. The US Federal Reserve added 0.75% to the Fed Funds rate while the European Central Bank and the South African Reserve Bank also increased their rates with the same margin. The Bank of England added 0.5% to their official interest rate but the Bank of Japan bucked the trend by keeping their rates unchanged after their meeting in September.

- August’s inflation number in the United States came in at 8.3%, well above the expectation of 8.0% and thus solidifying fears that inflation will continue to remain high. This has seen the S&P500 plunging to its worst sell-off since June 2020. Even though the price of energy fell, prices of most other items in the consumers basket, including essentials like food, rent and medical care, are still rapidly rising.

- Retail sales (excluding auto fuel) in the United Kingdom dropped by 1.6% in August as surging prices put pressure on disposable incomes. This means consumer spending has fallen by 5.0% over the past 12 months. This highlights the continued weakness of the UK economy, a situation that has resulted in sterling hitting a 38-year low versus the US dollar. The figures also throw a spotlight on the difficult situation facing policymakers in the UK, where the government is trying to stimulate sluggish growth while the Bank of England (BoE) is trying to control inflation, which is running at 9.9% year-over-year.

- Spillovers from the Russian Federation’s invasion of Ukraine are set to hasten the deceleration of global economic activity, which is now expected to slow to 2.9 percent in 2022. The war in Ukraine is leading to high commodity prices, adding to supply disruptions, increasing food insecurity and poverty, exacerbating inflation, contributing to tighter financial conditions, magnifying financial vulnerability, and heightening policy uncertainty.

- Queen Elizabeth II, the UK’s longest-serving monarch, died at Balmoral, aged 96, after reigning for 70 years. Her son, King Charles III, said the death of his beloved mother was a “moment of great sadness” for him and his family, and that her loss would be “deeply felt” around the world.

- Liz Truss became prime minister of the United Kingdom on 6 September. Among her first actions Ms. Truss announced a support package to help households and businesses weather the extreme energy price rises caused by Russia’s invasion of Ukraine. The cost of the package is expected to exceed £150bn.

- Hurricane Ian made landfall in Florida, United States, at the end of October. Ian was a massive Category 4 storm with winds of up to 250km/hour. It was one of the strongest storms to ever make landfall in the state as well as in the whole of US, leaving more than 2 million people without power. The occurrence of disasters like these underlines the importance of the battle against global warming.

- In South Africa, electricity supply woes continued as load shedding was ramped up during September. Public Enterprises Minister Pravin Gordhan said he will “restructure and reconstitute the Eskom board”. The board was announced on Friday 30 September.

- The South African Reserve Bank adjusted their economic growth expectations for South Africa upward, albeit marginally: the local economy is forecast to expand by 1.4% in 2023 and by 1.7% in 2024.

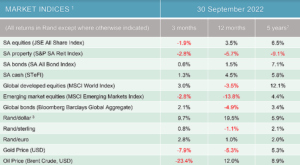

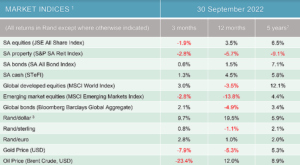

Market Performance

- Source: Factset

- All performance numbers in excess of 12 months are annualised

- A negative number means fewer rands are being paid per US dollar, so it implies a strengthening of the rand.

Page load link