April 2023 In Review

-

Joe Biden formally announced that he would seek a second term in office. The New York Times reported that, while the president once pitched himself as “a bridge” to a new generation of Democratic leaders, he has decided that he is not ready to turn the torch over yet. Kamala Harris featured prominently in Biden’s re-election video, underscoring the central role she is likely to play in the president’s re-election bid.

-

Fierce fighting across Sudan has left hopes for a peaceful transition to civilian rule in tatters. Forces loyal to two rival generals are vying for control, and as is so often the case, civilians have suffered the most. By 2 May an estimated 100 000 people had fled the country. Another 300 000 to 400 000 have been displaced within the country, mainly due to the fierce fighting in the capital Khartoum.

-

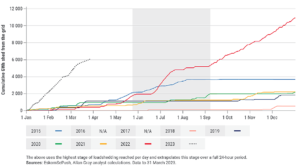

Loadshedding in South Africa shows no signs of abating. Despite the appointment of a minister with only one job, South Africans have, in the first quarter of 2023 alone, suffered as much loadshedding as they had for the first three quarters of last year, and in no other year prior to that:

-

The US Federal Reserve’s Open Market Committee (FOMC) increased their official lending rate by another 0.25% early in May. It is now in the 5% to 5.25% range. Notably, the Fed dropped from its policy statement language that it “anticipates” further rate increases would be needed. At a press conference following the release of the statement, Fed Chair Jerome Powell said inflation remains the chief concern, and that it is therefore too soon to say with certainty that the rate-hike cycle is over.

-

Against the backdrop of its more hawkish stance, the European Central Bank (ECB) raised interest rates by 0.25% to 3.25% and signaled that more tightening would be needed to tame inflation. The central bank for the 20 countries that share the euro has lifted rates by a combined 3.75% since July 2022, its fastest pace of tightening. ECB President Christine Lagarde made it clear that further action was likely, given mounting wage and price pressures.

Market Performance

Market participants continue to interpret weaker economic data as positive for financial markets. This drove equity markets to their best level in almost a year. The rationale behind this move appears to be that weaker economic growth will force central banks to cut interest rates as they will be willing to tolerate higher inflation in return for boosting growth.

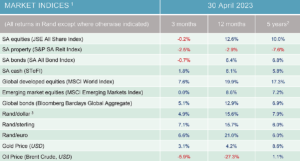

Global developed market equities returned 1.8% in April (measured in US dollar), but emerging markets retreated by 1.1%. April was relatively calm in global fixed-income markets after an extraordinarily tumultuous March. The market increasingly priced in the prospect of a 25bps Fed hike and global bonds ended the month 0.4% higher.

Locally, continued loadshedding contributed to negative sentiment in markets and the rand. The bond market was weaker with the SA All Bond Index returning -1.2%. The rand ended the month at R18.29/$, over 3% weaker. With less than 25% of total company revenue in the JSE All Share Index exposed to the local economy, South African listed equities bucked the trend and ended the month 3.4% higher.

- Source: Factset

- All performance numbers in excess of 12 months are annualised

- A negative number means fewer rands are being paid per US dollar, so it implies a strengthening of the rand.