Economic and Market Overview

May 2022

Global

Rising inflation and increasing interest rates are front of mind for most investors as the effects of the war in Ukraine seem to be priced into markets.

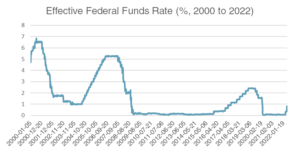

Jerome Powell, chairman of the US Federal Reserve, announced on 5 May that the benchmark interest rate has been increased by 50-basis points. This is the biggest increase in 20 years but is still in line with market expectations. This move is their most aggressive step yet in the fight against 40-year high US inflation.

in 20 years but is still in line with market expectations. This move is their most aggressive step yet in the fight against 40-year high US inflation.

In the news conference following the announcement, Powell said that “inflation is much too high and we understand the hardship it is causing. We’re moving expeditiously to bring it back down.” He further noted the burden of inflation on lower-income people, saying, “We’re strongly committed to restoring price stability.” These comments equate to, according to the chairman’s comments, multiple 50-basis point rate hikes ahead, though likely nothing more aggressive than that.

Source: US Federal Reserve

According to Guy Monson, chief strategist at Sarasin and Partners, the rate is likely to be increased by a further 50 bps at each of the next few meetings, bringing it closer in line with the assumed neutral rate of 2.25%. They predict that the expeditious implementation of interest rate increases is likely to be quite challenging for investment markets, even with underlying earnings and dividends being quite robust. It will provide further challenges for bond markets, and probably increase volatility. But the broad direction of policy is the right one, and there is confidence in the Federal Reserve’s policy. This is ultimately good for asset class returns.

Looking ahead, the macroeconomic picture remains uncertain. Laurium Capital reports that economic growth is slowing more rapidly than envisaged at the start of the year, and inflation pressures are stickier. Nevertheless, market prices have adjusted very rapidly to the unfolding events, and bearish positioning is now extreme. It is a testing time for policymakers as well as investors.

South Africa

The Rand depreciated by a substantial 7.6% in the month of April.

The ZAR/USD exchange rate has weakened dramatically since its closing level of R14.51 to the US dollar on 12 April. A combination of US dollar strength and ominous domestic headwinds have conspired to drive the exchange rate up to levels (at the time of writing) of over R16 to the US dollar.

Many of the tailwinds that have supported the rand over the last few years are starting to diminish. With the exception of oil, most commodity prices have pulled back from their recent highs, causing both South Africa’s terms of trade as well as its current account balance to move in a less favourable direction. Economic growth has also been below expectations, placing additional pressure on the rand’s exchange rate against most developed market currencies.

their recent highs, causing both South Africa’s terms of trade as well as its current account balance to move in a less favourable direction. Economic growth has also been below expectations, placing additional pressure on the rand’s exchange rate against most developed market currencies.

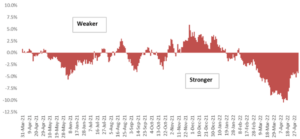

The Analytics Currency Decoder shows that the rand is still cheap relative to fair value, but not by the same margin as a month ago:

ZARUSD relative to estimated fair value:

Source: Dr. Lance Vogel, Analytics

RMB Global reports that they have revised their 2022 GDP growth forecast down to 1.5% year on year (from 1.9% before). This is attributed to their expectation that the ongoing war in Ukraine as well as lockdown restrictions in China will weigh on global growth and thereby growth in South Africa too. In addition, they expect the slightly higher interest rate trajectory to be a drag on household consumption and thereby domestic economic growth. Furthermore, they think the recent floods in Kwazulu-Natal also pose a risk to growth. The damage to infrastructure such as the collapse of bridges, resulting in road closures, is likely to hinder economic activity and disrupt the transportation of goods. Given security issues and bottlenecks on the Transnet railway and ports, they expect the impact of the positive terms of trade on real GDP growth to be negligible, though there could be a risk to the upside.

With reference to South African inflation, they expect headline CPI to average 5.5% this year – up from 4.6% last year. Their forecast is for headline inflation to peak at 6.0% in June and eases thereafter to end the year at 4.6%. Inflation is clearly not such a big issue in South Africa as it is abroad, but this is unlikely to stop the upward trajectory of interest rates set by the South African Reserve Bank.

Market Performance

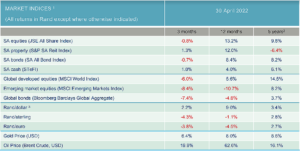

Global markets sold off in April after a brief reprieve in March as uncertainty intensified around the impact of higher interest rates in the US, COVID-related lockdowns in China, and the impact that Russia’s continued attack on Ukraine will have on global economic growth.

In their monthly market update, Visio Capital reported that the broad sell-off is posing an increasingly difficult challenge to investors as it appears that there is no place to hide with even safe-haven assets such as US Treasuries and gold performing poorly. The MSCI World Index lost -8.3% in US dollar terms during the month while emerging markets (-5.5%) fared only slightly better. Year to date both these broad indices have given up more than 12% in dollar terms.

South African equities followed global markets lower in April, performing in line with other emerging markets but continued to do better than developed markets. Domestic bonds, however, after outperforming their emerging and developed market counterparts by wide margins over the last few months, underperformed as the rand had its worst month in 2 years, losing 7.3% against a particularly strong US dollar, which gained 4.7% against its trade-weighted basket.

Domestic bonds, however, after outperforming their emerging and developed market counterparts by wide margins over the last few months, underperformed as the rand had its worst month in 2 years, losing 7.3% against a particularly strong US dollar, which gained 4.7% against its trade-weighted basket.

The ZAR/USD ended the month on the same level as at the start of the year, however, it has not been a smooth ride. After reaching R14.45 against the US dollar on 13 April it quickly returned to R16 per US dollar by the end of the month.

In commodity markets, gold and oil remained flat in April but both have still outperformed most other broad asset classes by some margin in 2022.

- Source: Factset

- All performance numbers in excess of 12 months are annualised

- A negative number means fewer rands are being paid per US dollar, so it implies a strengthening of the rand.

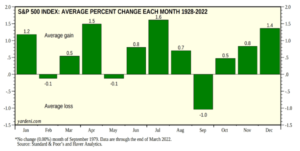

first four months of the year and many investors are disappointed with the lack of growth in their portfolios. As we reported at the start of the year, it’s not wise to change an investment strategy after a period of poor performance. More often than not investors are likely to destroy value rather than create it if strategy alterations are based on recent market performance. Historically it would not have been wise to be out of the market between May and September (St Leger’s Day is typically in the first half of September). The main US stock market index has, on average, delivered strong positive returns from June to August over the last 100 years:

first four months of the year and many investors are disappointed with the lack of growth in their portfolios. As we reported at the start of the year, it’s not wise to change an investment strategy after a period of poor performance. More often than not investors are likely to destroy value rather than create it if strategy alterations are based on recent market performance. Historically it would not have been wise to be out of the market between May and September (St Leger’s Day is typically in the first half of September). The main US stock market index has, on average, delivered strong positive returns from June to August over the last 100 years: