Economic and market overview

Global

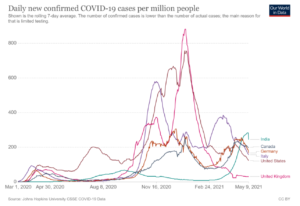

A resurgence in Covid-19 infections, especially in India, caused some discomfort among investors. Accompanied by a less than smooth roll out of vaccinations in most territories it’s not yet clear that the world has put the pandemic behind it.

India’s reached a stage where more than 400 000 Covid-19 cases are reported every day. This is a very high number in absolute terms, but expressed as number of cases per million citizens (bearing in mind India’s population is approaching 1.4 billion people) this is still much lower than the peak of the previous waves’ experience in many other countries, including the United Kingdom, Italy, the United States and Germany:

Against this backdrop the global economy still seems to be on its recovery trajectory and investment markets have not been left behind. According to the World Bank’s Global Monthly report of April, high frequency economic data still points to a strengthening of global growth, led by the United States. This continued growth is also fueled by continued benign global financial conditions (low interest rates and asset purchase programs of central banks). These accommodative monetary and fiscal policies are likely to continue in the wake of the recent rise of Covid-19 cases.

Despite the challenges experienced with the roll-out of various vaccines, progress definitely is being made, and early in May one in 12 people around the world has had at least their first dose. At the end of March 2021 this ratio was one in 20. Even though the disease won’t be eradicated any time soon the progress made in the coming months will go a long way to get many parts of the global economy going again, including travel and tourism. Much of this is reflected in market valuations though – remember that if it’s in the press, it’s in the price.

South Africa

The move by the African National Congress to suspend party members who did not voluntarily step down while facing criminal charges was widely lauded and will go a long way to reinstate investor appetite for South African government bonds and equities.

Even more important is the better-than-expected performance of the South African Revenue Services in collecting taxes accompanied by the National Treasury’s decision to lower the size of the weekly government bond auction. This decision follows Treasury managing to sell more bonds than required to fund the national budget deficit. Both these developments should be positive for investor sentiment.

The rand has also gained in value against the United States dollar this year, and has bucked the recent trend of some other emerging market countries who lost value versus the greenback. In fact, the rand is trading close to levels previously seen in 2015, shortly before Nenegate:

A positive trade balance also contributed to the recent strength of the local currency. This has been supported by a rise in the value of South Africa’s metal (and other commodity) exports while our imports have remained subdued. According to Johann Els, Old Mutual Investment Group’s chief economist, further support for our local currency could come from continued foreign buying of South African bonds, which – over the medium term – could increasingly extend to South African shares. As foreign investors re-assess their views on South Africa, they are considering the positives, including low inflation, a strong financial sector and a conservative, independent central bank.

Speaking of inflation – Headline CPI for the 12 months to March increased to 3.2% (2.9% in February) compared with consensus forecast of 3.3%, making it the 3rd consecutive downward surprise. According to Visio Capital, food and energy prices are likely to rise further over the next few months due to both base effects and higher international prices, pushing headline inflation to a cyclical high of close to 5% before easing back to below the middle of the target range in the second half of 2021.

Considering the deluge of bad news about South Africa just a year ago the current picture looks a lot rosier than what many would have expected. Much of this has been reflected in our investment markets as most of the so-called SA Inc. (domestically focused) shares on our local stock exchange showed strong recoveries over the last 12 months.

Market performance

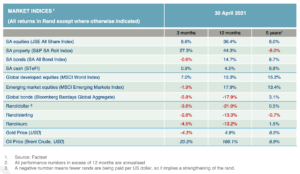

The effects of fiscal and monetary authorities around the world to reflate the global economy continued to support equities while bond markets struggled.

Reflation is a fiscal and/or monetary policy designed to expand output, stimulate spending, and curb the effects of deflation. It usually occurs after a period of economic uncertainty or a recession like the synchronized economic lockdown during the early stages of the COVID – 19 pandemic.

Most developed market equity indices recorded all-time highs during April. Emerging market equities ended 1.5% higher (measured in US Dollar) but underperformed developed markets which gained 3.9%. Both emerging and developed markets are now more than 50% higher than their March 2020 lows.

Visio Capital reports that South African equities (+1.0%) recorded their 6th consecutive month of positive returns led by the resources sector (+2.9%) which benefited from higher metal prices. The market was held back somewhat by index heavy weights (Naspers -6.3%, British American Tobacco -4.4%, and Amplats -7.8%).

Improving terms of trade, a record trade surplus in March and improved risk appetite drove the rand (+1.8%) to its best level against the greenback since before the COVID-19 crisis.

Domestic bonds added nearly 2% for the month while property stocks gained over 11%.

Commentary – GameStop, Artificial Intelligence, Social Media, and the Future of Investing

By Sameer S. Somal, CFA and Pablo A. Ruz Salmones

This article was first published in Enterprising Investor – an initiative of the CFA Institute.

By now, everyone (with an interest in “playing the stock market”) has seen the headlines. The revolution has started. GameStop’s stock price was  suddenly, artificially sent soaring. A once-mighty videogame retailer whose prospects had been laid low by the transition to digital and streaming — as well as the global pandemic — experienced an out-of-nowhere jump in market value of tens of billions of dollars:

suddenly, artificially sent soaring. A once-mighty videogame retailer whose prospects had been laid low by the transition to digital and streaming — as well as the global pandemic — experienced an out-of-nowhere jump in market value of tens of billions of dollars:

That was weird enough, but the story behind it was even weirder.

An ad hoc army of amateur investors spurred the value spike. They had organized on the WallStreetBets forum on the social networking site Reddit in a bid to defy the shorting practices of several elite hedge funds. As a result, GameStop’s stock price crested higher than ever before, rising more than 1,700%, and the mighty hedge funds were caught in a short squeeze.

For better or worse, the little guy, or many, many little guys, had briefly beaten Wall Street at its own game. And GameStop wasn’t alone. The theater chain AMC and the old mobile phone outfit BlackBerry experienced stock price surges due to this kind of social media influence.

Many Small Voices, or a Really Big One

While the GameStop event was fuelled primarily by the collective action of many, the voice of only one person, echoed by others, can have similar influence. For example, Elon Musk has more than 40 million Twitter followers and by adding “#bitcoin” to his Twitter bio and tweeting about dogecoin he has sparked cryptocurrency market events.

Whether influenced by one or many, the result is clear: Social media can drive today’s markets. Such incidents, combined with their capriciousness and unpredictability, have led to pushback from the financial establishment and calls for greater oversight of social media practices and businesses. Musk, for example, has drawn attention from financial authorities over what he claims were merely his offhand tweets. This is to be expected. When money is at stake, questions are bound to come up.

Trying to Contain the Social Media Monster

India introduced new rules for large tech and social media companies that require faster removal of content deemed “unlawful” by the government, easier ways to determine who posted it, and stricter direct oversight of streaming content. Regulatory initiatives in Australia and Europe have also sought to rein in social media companies. As a result, free speech advocates have raised concerns about censorship and inappropriate government control.

Much of this is simply due to the law of cause and effect. Tech and social networking giants have perhaps the largest user bases in the world. They have immense power, but neither they nor their users can flex that muscle without evoking a reaction. At times, social media can feel like a laissez-faire free-for-all. Indeed, part of the appeal of WallStreetBets is its foul-mouthed, anything-goes culture: If the mood strikes, its users can undermine ultra-wealthy hedge funds and upend market expectations.

And therein lies the problem. With social media, theoretically anyone can exercise the power that was not so long ago the privilege of the very few: to influence — or manipulate — opinion and get away with it. The recent testimony of top tech CEOs to the US Congress demonstrated the complete disconnect between the emerging powers of social media and their counterparts in government. Neither side understands the rules that govern the other.

Beyond the cause and effect is a rather complex question about balance. The scrutiny surrounding the social media giants is the established system’s reaction to their growing influence. The balance of power has shifted and with it the future of investing and social media.

The Forces behind Social Media: Algorithms, Artificial Intelligence, and Intensity

Who are the main players in this power shift? It’s not just governments and corporations. Right now, algorithms and artificial intelligence (AI) — and the people behind them — have far more influence than many realize. We might think we are playing the social media game, but in fact, the game might be playing us, whether we’re ultra-wealthy hedge funds or small-time investors on WallStreetBets. The question is how.

Changing minds and influencing behavior has always been the central purpose of media. Headlines are intended to grab our interest and spark  emotions that will impact how we think and act. There is nothing necessarily morally wrong about this. It has always been how perceptions are shaped. Even the most unbiased article retains a trace of the author’s opinion. What is different now is that “machines” — in the form of AI and algorithms — have been introduced into the equation and operate at unprecedented scale.

emotions that will impact how we think and act. There is nothing necessarily morally wrong about this. It has always been how perceptions are shaped. Even the most unbiased article retains a trace of the author’s opinion. What is different now is that “machines” — in the form of AI and algorithms — have been introduced into the equation and operate at unprecedented scale.

Because AI learns from the data it receives and social media has such incredible reach, the effect on public opinion is enormous and instant. Within a few seconds, a message can be transmitted across the globe and generate a near-automatic user response. Public opinion is modified at scale, immediately.

Algorithms are sets of rules computers use to identify, categorize, and sort information and solve problems. Every social media platform applies them to address requests and determine which data — pictures, posts, videos, etc. — to serve its users. With their efficiency and ability to personalize content, algorithms increase audience engagement, which gives the tech companies behind them a competitive advantage.

Each social media platform’s algorithm is specifically tailored to its distinct needs. Each is designed to increase and maintain audience engagement. When something becomes popular on social networks, it becomes really popular. Whatever catches on, whether it’s a meme, song, or video clip, it will be suddenly everywhere. The algorithms recognize the increased engagement and reward it with even more attention and higher rankings. The WallStreetBets investors who propped up GameStop’s stock were extremely engaged, which provided the mass attention and thus the investment needed to influence the market.

The process is iterative. An algorithm performs the same function over and over again, and the accompanying AI system examines the results, and then perfects them based on the engagement criteria. After a few million tests, the algorithm becomes incredibly effective at creating engagement among the millions it reaches.

The psychological result of all is massive, unprecedented social proof, validation, and power, a revolution with a taste of victory.

How much people’s opinions are affected by the social proof phenomenon created by AI is not necessary to quantify. The effects are palpable everywhere, in politics, culture, and stocks.

Where Did the Revolution Start?

If social media algorithms and AI are designed to increase and intensify user engagement, then how much responsibility do those users bear for market disruptions and other turmoil fueled by social media?

Tech companies rarely reveal how their algorithms and AI systems work. Reddit’s algorithm might have accelerated the GameStop phenomenon  because of its popularity. But many people facilitated that initial push. An algorithm could hardly have predicted the life the GameStop story would take on or the expansive media coverage.

because of its popularity. But many people facilitated that initial push. An algorithm could hardly have predicted the life the GameStop story would take on or the expansive media coverage.

Indeed, algorithms and AI do more for tech and social media companies than just generate user engagement. They also provide plausible deniability. Whenever a problem develops, firms lay the blame on some mysterious technological aspect of their business — a black box — promise to adjust and wait for the problem to blow over.

These companies don’t explain that unintended outcomes are inherent in these systems, that as human creations, every algorithm and AI can be designed with unintentional and unknown prejudices, assumptions, and blind spots embedded within them.

Conclusion

The future of AI, social media, and finance — of the technology-driven world — should be a promising one, full of automated conveniences and greater freedom. But to realize this outcome, our technological future must prioritize people. And real people don’t fit conveniently into the boxes of an algorithm.

It all begins with someone’s voice. As GameStop demonstrated, when that voice gathers support and is amplified by two of the most powerful tools the world has ever seen — AI and social media — it is a recipe for change.

What happened with GameStop was a taste of freedom and power, a small revolution with a taste of victory. For whom — or what? That remains to be seen.

Note: This article reflects the opinion of the authors. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employers.