February 2023 In Review

-

South Africa’s Finance Minister Enoch Godongwana tabled the 2023/2024 National Budget on 22 February. As widely expected, the budget was dominated by the electricity crisis. Another revenue windfall (due to elevated commodity prices) and savings on expenditure in 2022/23 provided some room for maneuver to respond to this. The Minister of Public Enterprises, Pravin Gordhan welcomed Eskom’s debt relief of R254 billion in the form of government servicing Eskom’s debt obligations for the next three financial years (both debt capital and interest). Furthermore, government will take up R70 billion debt from Eskom’s balance sheet, thereby reducing the debt burden further to sustainable levels. Eskom’s total debt at the end of 2022 was R422 billion.

-

In what was described as a market-friendly budget, other highlights include households and firms will be provided with tax incentives and relief from fuel levy hikes to mitigate the impact of the electricity woes. Treasury also responded to recent widespread floods across the country by making available R1.7bn in the next two years to assist with flood disaster relief.

-

Even though Eskom has dominated news flow during the month there is a possibility that water could become South Africa’s next big crisis. From an Ambunghane article (When crises collide: Water is South Africa’s next ‘perfect storm’) the key takeaways are:

-

In an already water-scarce country, demand outstrips supply, while water treatment plants falter and the country’s climate continues to warm at unprecedented — and deadly — rates.

-

After more than a decade of neglect, mismanagement, and corruption, the country’s water infrastructure can no longer supply many communities with reliable access to safe drinking water.

-

Wastewater treatment plants, meanwhile, dump raw sewage into waterways, likely fueling upticks in disease. And Eskom’s decline is hastening the gathering clouds.

-

-

The South African hedge fund industry grew its assets by an unprecedented 30% in 2022, ending the year with R113 billion under management. The industry’s assets under management stood at R87 billion at the end of 2021. The annual hedge fund statistics released by the Association for Savings and Investment South Africa (ASISA) also show that the industry attracted healthy net inflows of around R5.3 billion in 2022. This is still dwarfed by the total size of South Africa’s collective investment scheme industry which ended 2022 on R3.14 trillion.

-

Short-term Treasury yields in the United States reached their highest peak since July 2007, after new official data revealed the US economy remains in an overheated state. The ten-year Treasury yields, which many use as a benchmark for the economy, broke through 4% early in March. The latest increase has Wall Street worried about a potential recession – consequently, the Federal Reserve is now more determined than ever to rein in inflation.

-

Early in March President Cyril Ramaphosa finally announced his much-anticipated reshuffle of his Cabinet. Given their loss of support, it may go down in history as the last exclusively ANC-chosen cabinet before the country is potentially ruled by a national coalition government after the 2024 elections.

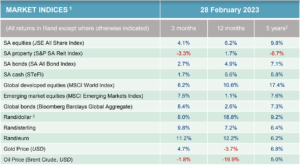

Market Performance

In their monthly market overview, Visio Capital reported that global financial markets gave back some of their extremely strong gains from January. This was on the back of continued strong economic data and the market focusing on the negative impact of higher interest rates rather than the positive impact on earnings and valuations.

Furthermore, the impact of China re-opening fizzled out as investors turned their focus to longer-term prospects for that economy. Equities were the worst-performing local asset class, suffering from a sell-off in resource stocks, while life insurers and banks held up despite a deteriorating macro backdrop.

SA bond yields ended the month higher, in line with global bonds. If inflation remains relatively elevated, it will likely lead to a more prolonged tightening policy cycle.

- Source: Factset

- All performance numbers in excess of 12 months are annualised

- A negative number means fewer rands are being paid per US dollar, so it implies a strengthening of the rand.