Economic and Market Overview

March 2022

Global

“War in Europe!” Who would have thought a few years ago that this would be a reality?

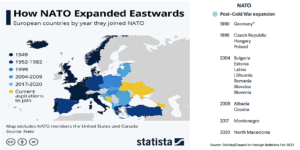

The armed conflict has been dominating news flow since Russian armed forces entered Ukraine on the 24th of February. It is an escalation of the Russo-Ukrainian War that started with the invasion of Crimea in February 2014. It seems as if Russia’s resentment over NATO’s eastward expansion was a big contributor to Putin’s decision to order the offensive.

Financial markets around the world did not have an immediate negative reaction, but as the conflict continued volatility has increased and European bourses, in particular, have started to show large declines.

Russia’s contribution to global economic output is not overly significant – it’s about 2% of worldwide Gross Domestic Product (GDP). Where there could be more significant implications is in Europe and China.

Europe imports a little over 50% of their natural gas and 25% of their oil from Russia. This means that the implementation of economic sanctions on Russia may be a case of cutting your nose to spite your face.

Around 70% of Russia’s trade (imports and exports) is with China. Given their political allegiance trade is unlikely to be impacted. What could have an impact, though, is the rise in prices of the goods moving between these two countries. It could have a detrimental effect on food prices in both countries. In addition to the economic sanctions, Russian banks’ exclusion from the global Society for Worldwide Interbank Financial Telecommunications (SWIFT) and frozen central bank assets may lead to a swift collapse of the Russian economy.

rise in prices of the goods moving between these two countries. It could have a detrimental effect on food prices in both countries. In addition to the economic sanctions, Russian banks’ exclusion from the global Society for Worldwide Interbank Financial Telecommunications (SWIFT) and frozen central bank assets may lead to a swift collapse of the Russian economy.

Against this background global growth is likely to slow further, but a recession is not on the horizon yet. The risk of escalation is high despite the optimism around peace talks which may be brokered by China.

Let us also not forget the human suffering that comes with armed conflict. Millions of lives will be impacted by the megalomania of a few, and our thoughts are with all of them. The sad truth is that war does not determine who is right. It merely determines who is left.

South Africa

South Africa’s finance minister Enoch Godongwana delivered his maiden budget speech on the 23rd of February.

The minister reported that South Africa’s macro-economic environment remains extremely challenging, reflected in declining GDP per capita figures each year for the past seven years, and a record level of unemployment that is considered alarming by global standards. At the same time, world economic growth is expected to slow over the next couple of years. According to the most recent World Bank economic update, global growth is expected to slow from 5.5% in 2021 to 4.1% in 2022 and 3.2% in 2023, as fiscal and monetary support is systematically unwound across the world, given the recent surge in consumer inflation.

seven years, and a record level of unemployment that is considered alarming by global standards. At the same time, world economic growth is expected to slow over the next couple of years. According to the most recent World Bank economic update, global growth is expected to slow from 5.5% in 2021 to 4.1% in 2022 and 3.2% in 2023, as fiscal and monetary support is systematically unwound across the world, given the recent surge in consumer inflation.

One of the government’s main concerns is the continued increase in South Africa’s debt burden. Although the outlook for the country’s future debt burden has improved from the Medium-Term Budget Policy Statement (MTBPS) in October 2021, it will be several years before the budget delivers a primary surplus:

Source: National Treasury

According to STANLIB Asset Management the 2022 budget was presented under difficult economic conditions, although the tax revenue windfall made the minister’s job significantly easier. In that regard, it is encouraging that the minister did not attempt to deliver a politically expedient budget given the ANC elective conference at the end of this year, nor was there any shock tax announcement. Instead, the minister reiterated the need to control expenditure over the medium term, while continuing the path of fiscal consolidation. In that regard, the success of this year’s budget will be determined by the government’s ability to maintain fiscal discipline, while at the same time ensuring that key policy initiatives are implemented much more effectively.

Although several policy options are available to revitalise the South African economy in the medium-term and therefore improve government finances, the range of workable solutions have diminished substantially over the past ten years given the destruction of the public sector’s balance sheet and the weakening of key public sector institutions, including many state-owned enterprises (SOEs).

At this stage, the most viable policy initiatives would still include substantially expanding the use of public-private partnerships, the extensive deregulation of the business sector in a concerted effort to make it easier to do business and lift business confidence, bold initiatives that make it easier and safer for foreign tourists to visit SA, the urgent clarification of key policy pronouncements, a demonstratable focus on restoring good governance and the urgent reorganisation of South Africa’s energy and water sectors.

Market Performance

Global equities faced heightened volatility and continued their negative trend as the MSCI All Country World Index slid 2.6% in February, with some European markets posting sizeable losses because of Russia’s invasion of Ukraine.

In the United States, the S&P 500 briefly traded in official correction territory and finished 3.0% lower in February, amid rising geopolitical concerns and uncertainty regarding the timing of the Fed’s tightening of monetary policy. Emerging markets retreated 3.4% in February, with the majority of countries (14 out of 25) increasing during the month. Russia (down 50.3%) posted its largest monthly decrease since August 1998, while Hungary (down 24.6%) and Poland (down 11.8%) also faced sizable declines.

regarding the timing of the Fed’s tightening of monetary policy. Emerging markets retreated 3.4% in February, with the majority of countries (14 out of 25) increasing during the month. Russia (down 50.3%) posted its largest monthly decrease since August 1998, while Hungary (down 24.6%) and Poland (down 11.8%) also faced sizable declines.

South African assets have held up particularly well once again, benefiting from a 9.7% increase in the PGM (platinum group metals) basket. South African equities outperformed their developed and emerging market counterparts. Local bonds, despite a sharp sell-off in the last week of the month, managed to record a positive return as their high yield was more than sufficient to compensate for the decline in capital value.

The rand remained stable against the US dollar, Pound Sterling, and the euro, and gained against most emerging market currencies. The gold price rose on geopolitical developments as investors allocated capital to defensive assets. At the time of writing, Brent Crude Oil was trading at nearly USD140 per barrel, not far off its all-time high of USD147.50 in July 2008.

- Source: Factset

- All performance numbers in excess of 12 months are annualised

- A negative number means fewer rands are being paid per US dollar, so it implies a strengthening of the rand.

Commentary – It’s Time To Halt

“Whenever you see a successful business, someone once made a courageous decision.”

Peter Drucker, Educator and Author

Successful investing is as much about good decision-making as anything else. Whether it’s the choice of adviser, fund, share, or timing of a trade, the world of investments exists because of decisions made – good or bad.

In most instances, these decisions are made by human minds. Artificial intelligence has evolved in leaps and bounds in recent years but is still light-years behind the power (and problems) of the human brain. Humans have endured a lot since their appearance on earth and have been through millions of “this time it’s different” episodes. Each one that followed was, with the benefit of hindsight, not that different to countless similar (if not the same) preceding episodes. And yet humans tend to repeat their mistakes despite having “seen this movie before”.

The World Health Organisation recently published a scientific brief: “Mental Health and COVID-19: Early evidence of the pandemic’s impact.”. Its main findings were

-

There was a significant (more than 25%) increase in mental health problems in the general population in the first year of the pandemic.

-

Younger age, female gender, and pre-existing health conditions were often reported risk factors.