Economic and market overview

Global

Speculation over whether the current state of inflation is transient or not dominated market commentary in recent weeks.

In their most recent Multi-Asset Monthly Commentary, Prescient Investment Management analysed the combined impact that the various fiscal packages in the United States will have on inflation, interest rates and the US dollar. On any measure, the size of the latest US fiscal package is very large. Moreover, it comes hard on the heels of a second fiscal stimulus in December 2019 and, if President Biden gets his way, not the last.

Given the new US stimulus package is once again focused on supporting near-term demand rather than long-term productive potential, a blind eye cannot be turned to the risk of overheating. Combined with the latest increases in the  price of oil and other commodities, as well as COVID-19 induced supply

price of oil and other commodities, as well as COVID-19 induced supply

bottlenecks, inflation is still the main concern in financial markets, contributing to the rise in global – and primarily US – bond yields.

The Federal Reserve’s Chair, Jerome Powell, insists that the Federal Open Market Committee (FOMC) will look through what it sees as a period of transitory inflation and that it will be very patient in waiting to see evidence of a sustained rise in inflation before raising rates: it will not be taking pre-emptive action based on forecast measures of slack in the economy, even the unemployment rate. Its new “outcome- based” forward guidance means it will not even slow the still hefty rate of asset purchases “until substantial further progress” has been made towards the FOMC’s maximum employment and inflation goals. Dependent on widespread, effective distribution of COVID-19 vaccines and an acceleration in economic growth through the middle part of this year, they expect the FOMC to keep financial conditions loose over the short- to medium-term.

Lastly: notwithstanding the ultra-accommodative monetary policy stance, Prescient’s longstanding negative view on the US Dollar is further supported by a widening fiscal deficit, which shows no signs of slowing down:

South Africa

The South African Reserve Bank’s Monetary Policy Committee (MPC) decided to leave the repurchase rate unchanged, keeping it at 3.5%.

All five of the MPC members voted to keep the rate unchanged and, in their statement, signaled that the next move is likely to be upwards. The Governor stated that, following an expansion in the South African economy of 6.3% in the fourth  quarter of 2020, the Reserve Bank’s forecast for South Africa’s first quarter growth stands at 2.7%. This is much stronger than the 0.2% contraction expected at the time of the March meeting. The economy is expected to grow by 4.2% in 2021 (up from 3.8%).

quarter of 2020, the Reserve Bank’s forecast for South Africa’s first quarter growth stands at 2.7%. This is much stronger than the 0.2% contraction expected at the time of the March meeting. The economy is expected to grow by 4.2% in 2021 (up from 3.8%).

The stronger growth forecast for 2021 reflects better sectoral growth performances and a more robust terms of trade in the first quarter of this year. Despite rising oil prices and a higher total import bill, commodity prices have risen to new highs, strengthening income gains to the economy. Household spending is expected to be healthy this year, in line with the easing of lockdown restrictions and low interest rates. This provided significant support for the rand against not only developed market currencies but also its emerging market counterparts. According to the Reserve Bank the currency is now close to its long–run equilibrium level.

This is also reflected in a Purchasing Power Parity chart compiled by Jean-Pierre du Plessis of Methodical Investments. They’ve calculated a fair value of the rand/dollar exchange rate of R14.16 at the end of April:

Investors who are considering an allocation away from rands should note that this is probably the most opportune time in the last 8 years when viewed on this basis.

Other than a change to the risk to its inflation forecast, which the MPC now sees to be to the upside (for the first time in over two years), there was little to guide market expectations as to the when the first interest rate hike will happen. It remains probable that the SARB will raise the repo rate either at the end of this year or early in 2022.

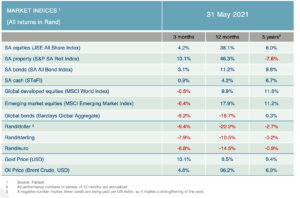

Market performance

Global equities set the tone for asset class returns in May as they edged up another 1.6% in US dollars during the month. Emerging equity markets outperformed their developed counterparts, although much of this came from general weakness in the greenback against a broad range of emerging market currencies during May:

Visio Capital reports that domestic bonds had a very strong month (3.7%), outperforming their emerging market peer composite by a significant margin as foreign investors returned as large net buyers (R9.3bn) and the rand continued its 12-month rally, appreciating by almost 6% against the dollar in May.

In the local equity market, banks (11.9%) and financials (9.2%) delivered strong performance while resources gave up some of their recent gains (-1.4%).

Commentary – The active side of passive investments

Passive (or systematic) investments have been in the spotlight of global investors for many decades. In recent years, and certainly post the Global Financial Crisis, South African investors have woken up to the various benefits of including these strategies in their portfolios.

During a recent investment conference, hosted by Boutique Collective Investments, Nico Katzke of Satrix argued that the devil is really in the detail when deciding on an appropriate passive investment strategy. With reference to the choice of an appropriate benchmark for active managers he quoted Daniel Polakow who stated that “(t)he choice [of benchmark] will be the single most important investment decision made in the long-only active equity space. The magnitude of that decision will almost always dwarf the importance of the manager’s active selection or any subsequent alpha value add. Of this there is little debate.”1 This is no less true for passive investment strategies, and even more so for systematic multi-asset investment strategies.

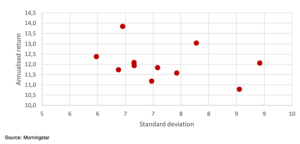

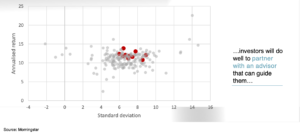

The scatter plot below shows the risk versus return trade-off for 11 multi-asset high equity strategies that have been available to retail investors in South Africa from 2017. This represents the typical risk profile that a long-term contributor to a retirement annuity or pension fund will consider under the restrictions of Regulation 28 of the Pension Fund Act:

It’s clear that not all passive strategies provide the same risk/return trade-off. Even though all of them are implemented based on some systematic or rules-based approach, there is still some element of human decision making. The choice of benchmark (as cited by Polakow) is probably the most important contributor to returns, but frequency of rebalancing, trading protocol and fund cost all add to the explanation in different returns.

In the plot above, the cumulative difference in returns between the highest and lowest performing strategy is just over 12% cumulative over a four-year period. This is a significant difference. It’s also not clear (from this short data series at least) that passive strategies with the highest risk provides the highest return.

1: Source: “The long and active existentialist”, Polakow DP, Journal of Asset Management, 2011

Commentary – The active side of passive investments

In the last instance it may be useful to consider our sub-set of systematic multi-asset strategies against their actively managed peers over the same period. Bear in mind that all these returns are after allowance for any fund-related fees:

Against the larger universe the choice between passive multi-asset strategies perhaps looks a little less daunting (or important) than what an investor may have thought. As a grouping, the passive funds seem to provide better four-year returns than the average actively managed strategy, but it’s not a guarantee by any stretch of the imagination. Passive funds, however, exhibit higher average volatility than their active counterparts. This may, however, become less of an issue as the investment horizon stretches.

It will be useful to repeat this same analysis when passive funds start to celebrate their 5 and eventually 10-year anniversaries. In the mean-time investors will do well to partner with an advisor that can guide them through the many choices to end up with a portfolio that bests suits their particular needs.