Economic and Market Overview

July 2022

Global

June saw a sharp increase in volatility and risk aversion in capital markets around the world as equity and bond markets alike sold off.

At the start of the year, many equity markets around the world had elevated valuation levels, but this has rapidly changed with price movement during the last few months. According to Laurium Capital, the quarter (and half-year) to June was brutal for equity markets. Following the already tumultuous early March sell-off when the negative effects of the Russian invasion of Ukraine and the strict Chinese Covid lockdowns first hit markets, the ongoing inflationary pressures that have continued to ripple through the global economy made the US Federal Reserve even more hawkish.

According to Laurium Capital, the quarter (and half-year) to June was brutal for equity markets. Following the already tumultuous early March sell-off when the negative effects of the Russian invasion of Ukraine and the strict Chinese Covid lockdowns first hit markets, the ongoing inflationary pressures that have continued to ripple through the global economy made the US Federal Reserve even more hawkish.

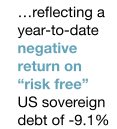

US interest rates were raised by 1.25% in the quarter, and the US forward curve prices in another 1.5% of interest rate increase by early 2023. US 10-year bond yields, factoring in both a higher risk environment as well as higher nominal inflation, rose to nearly 3% at the end of June. This first six months of 2022 rank as the worst-performing six-month period in over 40 years for the Bloomberg US Treasury Index, reflecting a year-to-date negative return on “risk-free” US sovereign debt of -9.1%.

Looking ahead, the primary risk to global equities from this point is company earnings. Analysts and company executives are still expecting high double-digit earnings growth over the next year; an expectation that seems optimistic given the extent of cost pressures and rising risks to consumer demand.

Energy prices are the key ingredient to the outlook for costs (and indeed overall headline inflation). A further move higher in oil and gas prices will be increasingly challenging to absorb in the real economy. Politicians, facing the wrath of an unhappy electorate who doesn’t like the cost of living rising, have thus far responded with very limited actions to improve things. Sanctions on Russian oil and gas have been limited to Western Allies and yet the market deficit has held the price of crude above $110/barrel despite ongoing sales from strategic stockpiles.

Political turmoil further added to risk aversion in markets. Presidents Biden and Macron and Prime Minister Johnson are all facing very low approval rates, with the latter unlikely to survive as the leader of the Conservatives for much longer.

From a pure valuation point of view, investment opportunities seem much more attractive than six months ago. Equity valuations fell with the MSCI All Country World Index one year forward Price-to-Earnings ratio falling to under 14 times from over 20 times a year ago. The index itself fell by 15.7% for the quarter and 20% for the half-year to end June. The decline marks this as a bear market, albeit not quite as extreme as the over 50% peak-to-trough decline of the global financial crisis of 2008, nor the more than 30% decline of March 2020 when economic lockdowns due to the Covid-19 pandemic introduced a lot of fear in markets.

South Africa

Eskom’s continued inability to provide consistent electricity supply was highlighted again in June as the country (and economy) struggled to cope with stage six load shedding.

Setting the most recent Eskom issues aside, available data looks to confirm expectations of slowing momentum in the second quarter of 2022 in any event. Construction and tourism improved, albeit remaining below pre-pandemic levels. Mining, manufacturing, and wholesale trade were materially weaker while retail and car sales held up. This, together with infrastructure damage due to the flooding in KwaZulu Natal, suggests that the economy stagnated in the second quarter. Once again it is clear that significant structural reforms by the government are required to attract private sector investment which is so dearly needed for a significant increase in economic growth.

tourism improved, albeit remaining below pre-pandemic levels. Mining, manufacturing, and wholesale trade were materially weaker while retail and car sales held up. This, together with infrastructure damage due to the flooding in KwaZulu Natal, suggests that the economy stagnated in the second quarter. Once again it is clear that significant structural reforms by the government are required to attract private sector investment which is so dearly needed for a significant increase in economic growth.

Strong terms of trade gains have bailed South Africa out of its fiscal crisis and this appears to have lowered the urgency of pursuing structural reform. Economic growth in the region of a little under 2% over the next few years means that the fiscal crisis has just been delayed, not averted.

South Africa does not have the same concerns about inflation as developed markets currently have, but inflation risks should not be overlooked. Headline year on year inflation for May increased to 6.5% (from 5.9% in April), breaching the upper end of the South African Reserve Bank’s inflation target for the first time in over 5 years. The outcome was the largest upside surprise to the consensus forecast since the beginning of 2009.

The jump in inflation, and the large surprise, are mainly attributed to the large increase in food prices (7.8% from 6.3% in April) with all subcategories recording an increase, most notably bread and cereals (8.4%) and meat (9.4%). Food and transport (due to the elevated oil price) continue to record the highest inflation and together make up well above half of the total inflation rate. However, the increase in household contents and equipment inflation is noteworthy. Although the category only makes up a small part of the basket and its inflation rate is still relatively low, the May year-on-year inflation of 4.3% is the highest in well over a decade, indicating a broadening of the inflation base. Overall, the upward surprise in May will have a material impact on the inflation trajectory for the next 12 months with inflation likely to peak above 7% and remain higher than the Reserve Bank’s upper end of the inflation target range well into 2023.

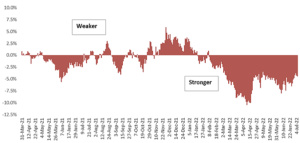

According to the Analytics Currency Decoder, fair value for the rand is now over R17 to the US Dollar. At current levels it implies that the rand is stronger than can be expected:

ZAR/USD relative to estimated fair value

Source: Dr. Lance Vogel, Analytics

Market Performance

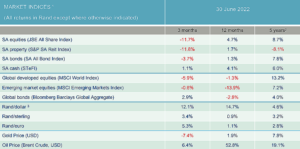

Global and local markets sold off in June with investors struggling to find any place to hide.

An increased likelihood that taming inflation will require central banks to continue hiking policy rates to levels that will force economies into recession, has led to a steep increase in volatility and risk aversion. While equity markets were the big losers, developed market bond yields continued to rise, resulting in their worst quarter in at least 4 decades, while cash was the best performing asset class across the board.

Global equities are now 20% lower (when measured in US dollars) than at the start of the year. Global bonds did not fare much better as they had given up nearly 14% over the same period. South African equities held up much better in both local currency and US dollar terms. The broad local equity market is down 8.3% for the year-to-date and local bonds have shed 2%.

same period. South African equities held up much better in both local currency and US dollar terms. The broad local equity market is down 8.3% for the year-to-date and local bonds have shed 2%.

A strong rally in Naspers and Prosus helped the Industrials index to end in the green. Resources and financials followed their global counterparts deep into negative territory. This fall in share prices has, however, created many attractive investment opportunities as valuations look particularly attractive in some sectors of the local market.

The rand followed many other emerging market currencies in selling off against the US dollar during June. Year-to-date it however remains one of the strongest currencies around the world and has given up only 2.5% against the greenback and strengthened significantly against the Pound Sterling and euro.

- Source: Factset

- All performance numbers in excess of 12 months are annualised

- A negative number means fewer rands are being paid per US dollar, so it implies a strengthening of the rand.

Commentary: Space – The next frontier

While a power-hungry Russian leader attempts to increase their territory and control, it’s perhaps a good time to consider the very early developments in another territorial race – the one for space.

race – the one for space.

At a recent investment conference in London, Tim Marshall spoke about the race for (and principles of) control of the space beyond the earth’s atmosphere: