Economic and market overview

Global

Risk appetite started the month on a positive note with many major equity indices recording all-time highs during the month.

Global equity markets remain supported by very accommodative monetary and fiscal policies at a time where global economic growth is expected to increase at its fastest rate in decades. Despite (and perhaps because of) lessening lockdown restrictions in the United States, Great Britain and most of Europe, it won’t be an easy ride to recovery as the Delta variant of the Coronavirus spreads at an alarming rate around the world. A subtle but noticeable change in the stance of the US Federal Reserve’s Open Market Committee (FOMC) following their mid-month statement added further uncertainty among investors. The market’s interpretation of the June FOMC meeting was that it underwent a “hawkish pivot”. Interest rate expectations for 2023 jumped from no hikes to two hikes, the Q&A session confirmed that the Fed is “talking about talking about tapering” and that it has become less certain on the transitory nature of the current inflation surge. Immediately afterwards risk appetite moderated and volatility rose with a significant impact on emerging and currency markets.

Matrix Fund Managers reports that, towards the end of the month, Covid jitters increased amid the broadening prevalence of the Delta variant. This more  contagious version of the Covid-19 virus has come at a time when the vaccine rollout in the developed world has lost pace, with levels still short of ensuring herd immunity. Emerging Markets are notably worse off, with many of the middle to lower income countries having vaccinated less than 10% of their populations:

contagious version of the Covid-19 virus has come at a time when the vaccine rollout in the developed world has lost pace, with levels still short of ensuring herd immunity. Emerging Markets are notably worse off, with many of the middle to lower income countries having vaccinated less than 10% of their populations:

The longer-term outlook for asset markets will depend on the momentum in liquidity. On this front, the rate of change has started to moderate. This is happening not only in China but also in the Federal Reserve’s balance sheet expansion. In short, central bankers and finance ministers are walking a very tight rope with not much room for policy error. Investors expecting a smooth ride towards the end of the year will most certainly be disappointed.

South Africa

The vaccine roll-out in South Africa remains disappointing, with the silver lining being that every day more people are receiving the jab.

Another encouraging development is that registrations for younger cohorts of the population have now opened and surveys of the willingness to vaccinate are surprisingly high.

In a recent report Carmen Nel, economist of Matrix Fund Managers, provides a sober outlook on the South African economy. While SA has moved to lockdown level 4 amid the rampant spread of the Delta variant, particularly in Gauteng, the economy continues to benefit from the cyclical breather provided by the positive terms of trade. Economic activity (measured by GDP) and the current account balance beat expectations for the first quarter and tax revenues continue to recover. Following the better-than-expected data, consensus forecasts for 2021 GDP growth has climbed to above 4.0% and the budget deficit is projected to be comfortably below 8% of GDP. At this stage, the impact on productive sectors should be minimal, with the curtailments focused on the hospitality (restaurants), entertainment, and alcoholic beverage industries. This poses modest downside risk to economic growth in the third quarter, depending on the duration of restrictions.

While CPI inflation breached 5% in May, it should prove temporary as the base effects start to reverse from June onwards. The key upside risks to inflation are the higher oil price and elevated food price inflation, as these could test inflation expectations. Rising inflation expectations would signal the emergence of second round effects, which would probably prompt the SARB to remove some policy accommodation. The market is now expecting two interest rate increases in the second half of 2021, with a third penciled in for January 2022.

While the SARB celebrated its centenary on 30 June 2021, President Ramaphosa’s reform and clean-up agenda received much-needed impetus. SAA was partially privatised, even if funding is yet to be finalised, and the president increased the threshold on embedded generation to 100MW.

Even though South Africa’s growth path has been knocked off course there are several encouraging developments aside from those mentioned above. Once the vaccination process gathers momentum (and it eventually will) and investors (especially foreigners) gain confidence from the structural reforms and clampdown on corruption, South Africa’s economy and investment markets are likely to benefit handsomely.

Market performance

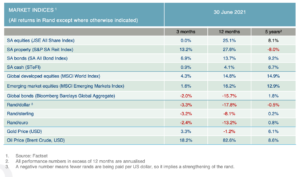

Global equity markets forged ahead in June but the South African equity market retreated on the back of falling commodity prices.

Many of the major equity indices around the world recorded all time highs mid month before pulling back as the Federal Reserve turned hawkish and the Delta variant of the Coronavirus spread at an alarming rate. The MSCI World index still ended the month 1.5% higher (in US dollars) with emerging markets lagging their developed counterparts by ending only 0.2% higher.

The bond market reflected a view that the current increase in inflation is transitory as the difference between short and long dated bond yields across most major markets reduced during the month.

Domestic equities performed poorly in June (-2.4%), recording their first negative monthly return since October last year. The weak performance was led by the resource sector (-6.5%) which suffered from a sharp decline in metal prices while the banking sector also performed poorly (-3.2%), taking a breather after a very strong performance in May.

The rand gave up some of its impressive gains so far this year as it retreated by about 4% against the US dollar. Some of this movement can be ascribed to strength in the greenback following the FOMC’s change in tack on future interest rate increases.

Gold and platinum prices both declined during the month but the oil price gained over 8% (in US dollar) as political tensions among OPEC and other oil producers were on the rise.

Commentary – An alternative investment that’s music to your ears

In a world with low inflation and low interest rates, high price to earnings or price to book multiples, low dividend yields and falling rents, investors are constantly looking for alternative investments. Infrastructure, hedge funds and private equity are popular destinations outside of conventional asset classes, while art, classic motor cars and wine are some of the more esoteric options for investors.

Most of these investments are tangible, but a significant portion of asset backed securities available to investors are backed by intangible assets. An early example of this is “Bowie Bonds” – named after the late musician David Bowie. In 1997 Bowie, in association with David Pullman, came up with the idea to sell the rights to the future royalties from his extensive body of creative work. Securitisation, effectively a loan backed by future payments, was in its innovation stage. These bonds were the first in a line of “Pullman Bonds” developed by David Pullman.

To understand the mechanism of Bowie’s transaction some perspective is needed. Stocks and bonds are the financial pillars of a modern economy. When a company issues stock, it sells ownership shares to raise money. No fixed schedule of payment on principal or interest is expected, but this so-called equity investment depends on good profit returns for the buyer of stock. Of course, not every business wants to sell a controlling stake. In that case, debt financing is the alternative. Debt financing can be done in two ways, either by taking a loan from a bank or by issuing bonds.

Bank loans tend to be expensive and the amount of financing involved is limited. Not so with bonds, which help raise cash for municipalities and cities,  corporations, and the federal government (the largest borrower of all). In general, a bond is just a promissory note of payment paid to bondholders in a stipulated period of time, with periodical fixed interest rate payments and a guarantee that the full amount of the principal is going to be returned at maturity.

corporations, and the federal government (the largest borrower of all). In general, a bond is just a promissory note of payment paid to bondholders in a stipulated period of time, with periodical fixed interest rate payments and a guarantee that the full amount of the principal is going to be returned at maturity.

Individuals can exceptionally become bond issuers if they have an attractive enough pool of assets they can securitize to back up the bonds. This was the case of Bowie. Moreover, one of the reasons bonds are so attractive as a financial instrument is that they can be liquidated at any time after purchase: unless the issuer defaults, which is rare, institutions or retail investors can always recover their loan if they themselves need cash at short notice.

Back to Mr Bowie. He struck a licensing deal with EMI for his back catalogue, giving the group the rights to release 25 Bowie albums from between 1969 and 1990. These included his most popular works – Ziggy Stardust, Aladdin Sane, Hunky Dory and Let’s Dance – as well as unreleased studio and live recordings. He was guaranteed more than 25 per cent of the royalties from wholesale sales in the United States.

Those rights were then securitised, turned into $55m of Bowie Bonds, offering a 7.9 per cent annual coupon. The bonds were “self-liquidating”, meaning the principal declined each year, and the rating agency Moody’s blessed the deal with an investment grade credit rating.

A brief vogue for creative rights allowed James Brown and the Isley brothers to sell similar bonds, and Rod Stewart raised $15m from a loan securitised against his future earnings.

The markets, though, did not predict the rise of Internet piracy and the single song format after Apple iTunes, both of which hurt album sales and sound recording royalties. By 2004, Moody’s had cut Bowie’s bond rating to BAA3, only one level above junk.

Commentary – An alternative investment that’s music to your ears (continued)

Nonetheless, the original 10-year Bowie bond was paid off in full at maturity in 2007, when Bowie resumed sole ownership of his music and royalties. Luckily for Bowie, this was right before the financial crash of 2008, which pretty much ended the celebrity bond market. James Brown, for instance, fared badly with his own bond. Finding the payment of interest hard, he asked to convert his old bonds into new ones at a lower rate with no avail. Pullman, who had brokered the bonds for Brown, rejected the idea because the bonds were relatively new. Additionally, the market interest rate did not support such a transaction, and the deal had to be done with the consent of the bondholders, which was unlikely.

bonds for Brown, rejected the idea because the bonds were relatively new. Additionally, the market interest rate did not support such a transaction, and the deal had to be done with the consent of the bondholders, which was unlikely.

Reflections

David Bowie, together with David Pullman, first put on the table the idea of royalty-backed securitization and made an intangible asset pool of intellectual property ultimately the equivalent of a firm loan collateral, such as a house in a mortgage or a car in a car loan. This could have implications for the future of music and other forms of intellectual property. Miramax, the film studio, has securitized $250 million of 3.34% notes due 2026 against the future cash flows of its library of films. Also, Bloomberg indicated that according to data from Barclays, bonds that are backed up with intangible assets comprised 21% of all U.S asset-backed securitization in 2015 and that segment of the market grew faster than other more traditional sectors.

Bowie’s bonds, in short, have come a long way. But very few artists today would seem to offer the guarantees that would attract outside investors, such as Bowie did. And even if the loan collateral were expanded from publishing and recording revenue to a share in live music receipts, a bet on a celebrity artist would still be risky in a world were the value of that intangible pool of royalties is less clear when technology changes.

Finally, it is good to remember that Bowie was willing to surrender and transfer the rights of the assets that were pertinent to the deal to a separate legal entity not under his control. Only under this arrangement did lenders control the risk, for if Bowie went bankrupt the securitized asset pool would remain under the lenders’ control. In many ways, therefore, it can be said that no artist has tested his name in the markets as amply and successfully as Bowie did – and with such courage.

In a world where investment in the fourth industrial revolution often requires more intellectual capital than financial capital, alternative investments may take on shapes and forms that we’ve not seen before. Many of these will turn out to be fads driven by hype among social media users. Some, however, may just be a very clever investment that will enhance your current portfolio.

In the words of Bowie himself: “(we) don’t know where we’re going from here, but I promise it won’t be boring.”

Sources: “A short history of the Bowie Bond” – Financial Times

“Bowie Bonds – an appreciation” – Music Business Journal (Berklee College of Music)