Economic and Market Overview

January 2022

Global

2021 saw most developed countries emerge out of their pandemic lockdown-related recessions while emerging markets continued to struggle with vaccination roll-outs.

The discovery of the Omicron variant of the Covid-19 virus gave investment markets a scare in the last quarter, however, despite the jitters, they recovered to end the year very strong. Alongside the global pandemic two other themes emerged, both of which are likely to influence investment decisions in the next few years. Whether inflation will be temporary or more permanent is on the agenda of most investment meetings, and the influence of a move to net-zero carbon emissions will continue to enjoy more time in the limelight.

quarter, however, despite the jitters, they recovered to end the year very strong. Alongside the global pandemic two other themes emerged, both of which are likely to influence investment decisions in the next few years. Whether inflation will be temporary or more permanent is on the agenda of most investment meetings, and the influence of a move to net-zero carbon emissions will continue to enjoy more time in the limelight.

According to the Blackrock Investment Institute’s 2022 Outlook, the powerful restart of economic activity (seen in 2021) will be delayed – but not derailed – due to new virus strains. Central banks will start to raise rates but remain more tolerant of inflation. They see inflation settling above pre-Covid trends which implies that we’re going to be living with inflation for some time.

Blackrock also sees climate change and the race for the world to reach net-zero emissions by 2050 play into the complexity of investment markets. They view the transition as a supply shock contributing to higher inflation and playing out over decades. They make it clear that the navigation to net zero is not just something that will start in the future – it’s happening now. Supply shocks are here, and the tectonic shift toward sustainable investing is already playing out.

Even though we are not the world’s biggest fans of new-year economic predictions, it is interesting to note what investment professionals are considering when looking into their crystal balls. Invesco’s chief global market strategist expects the following developments in the year ahead:

-

The Omicron variant will be a negative force in the short run, exacerbating supply chain disruptions and aggravating inflation. Within a few months, however, Omicron is likely to be a positive force if it remains as mild as we have seen thus far. Because it is highly contagious, it appears to be crowding out the more dangerous Delta variant. It seems likely to rapidly move through countries, serving as a “de facto” immunizer (far faster than any vaccination program), which could mean the end of the pandemic by the end of the first half of 2022.

-

Emerging markets stocks are likely to have a very bumpy start to 2022 given the spread of the Omicron variant. However, for the full year, emerging markets equities are likely to outperform developed market equities, including US equities. They expect emerging markets growth to accelerate while the US and European economic growth decelerate to more normalised levels. Unlike 2021, Chinese equities are likely to help drive EM equities higher in 2022, helped by a re-acceleration of China’s economic growth, thanks to monetary and fiscal stimulus.

-

They expect at least one significant geopolitical crisis in 2022 (Russia invading Ukraine is at the top of the list of possibilities), but believe that markets will shrug it off within days after it occurs. In recent years, only trade woes have had a lengthier impact on markets, and even then it has been relatively short-term in nature.

-

They think that the 10-year US Treasury Yield will end 2022 higher than it is now as the Federal Reserve begins to normalise monetary policy.

-

Finally (no surprise here) they expect even more interest in environmental, social, and governance (ESG) investing in 2022, driven in part by a dramatic acceleration in electric vehicle adoption in the US, Europe, and China.

South Africa

South Africa’s struggles with getting its population to a state of herd immunity and realizing a slower economic recovery (at least when compared to the rest of the world) did not reflect in market returns for 2021.

Local equities and property lead the charge as both asset classes delivered stellar returns – up nearly 30% and 40% respectively. After 2020’s aggressive rate cuts, cash underperformed inflation for the first time in eight years with bonds delivering twice the average return of money market funds.

According to Laurium Capital, the South African economic rebound in 2021 was better than expected, buoyed by strong commodity demand and the reopening of supply chains, with the current account recording its strongest surplus in decades. As we roll into 2022, some of the tailwinds which the SA economy experienced during 2021 may begin to fade, with growth expected to revert to around 2% in 2022 and 2023. The structural challenges of elevated levels of unemployment, corruption, and defunct state-owned enterprises (particularly Eskom and Transnet) are expected to continue to constrain economic growth.

Data released during December showed that the economy fared worse than market expectations in 3Q2021, contracting by 1.5% compared with the consensus forecast of 1%. Visio Capital reports that, while the July unrest is the main contributor to weaker growth, the surprise came from the agriculture sector that contracted by 13.6%, shaving 0.4% from overall GDP growth.

Headline year-on-year inflation for November (released in December) increased to 5.5% (from 5% in October), its highest level since March 2017 while core inflation increased to 3.3% (3.2% in October). This is its 50th consecutive month that it is at or below the middle of the Reserve Bank’s target range. The increase in headline inflation was largely a result of the higher fuel price which increased by 7.1% in the month translating into a 34.5% annual rise and accounted for the full 0.5% higher inflation rate. Food inflation moderated to 6% from 6.7% in October and a cyclical high of 7.4% in August.

The cyclical nature of the current drivers of inflation means that headline inflation will moderate and should end 2022 around the middle of the inflation target range.

Economic growth forecasts for 2022 appear underwhelming (around 2% on average) as the economy continues to recover, albeit at a very slow pace as evidenced by the fact that the economy remains materially below its pre-COVID size. This also pales in comparison to an expected global economic growth rate of nearly 5% in 2022.

In their 4th quarter 2022 macro outlook, Terebinth Capital stressed the importance of structural reforms in assuring higher and sustainable economic growth in South Africa. They argue that the investment climate would be improved with the provision of sufficient energy for growth, reducing the impact of administered prices on overall inflation and stabilising public debt. The domestic economy would also benefit from permanently lower inflation (also argued by the governor of the Reserve Bank in a speech last year in Stellenbosch). This would better anchor inflation expectations, reduce the volatility of the rand and sustainably lower the neutral interest rate. The result would be immediate positive feedthrough to borrowing costs and structural increase in economic growth.

We’ve frequently argued for these structural reforms (which include more business-friendly labour laws, a clampdown on corruption, certainty on land ownership, and improved management of state-owned enterprises and assets) but the fact remains that it will take political will to bring it to fruition. May this year be the one where the ruling party stands up to be counted.

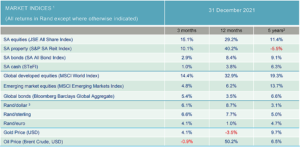

Market Performance

Asset class returns for the year were generally mixed but, when measured in rands, delivered positive returns across the board in 2021. This was partly due to the rand weakening almost 9% against the US dollar.

Global equities ended the year 19% higher (in US dollars). This can be attributed to the very strong performance of developed markets which gained over 22% in 2021, in stark contrast to emerging markets which lost a little over 2% (in US Dollars) for the year. The South African equity market outshone its developing market peers as it kept pace with developed markets when measured in the same currency.

Global bonds, which arguably entered 2021 in overvalued territory, lost almost 5% over the year. Gold and platinum did not fare much better as they gave up 3.5% and 10.3% respectively, but oil gained over 50%. Bitcoin more than doubled during the year but then pulled back to an end 60% higher.

On the local front property shares did particularly well (+40.2%) but over 5 years are still in negative territory. Local equities (+29.2%) also attributed to the strong performance across investment portfolios, while bonds (+8.4%) outperformed cash (+3.8%) quite easily.

Most emerging market currencies, along with the Euro struggled against the US dollar during the year.

The median South African balanced fund delivered over 20% to investors which was a welcome relief after a long period of more pedestrian annual returns.

- Source: Factset

- All performance numbers in excess of 12 months are annualised

- A negative number means fewer rands are being paid per US dollar, so it implies a strengthening of the rand.

Commentary – New Year’s resolutions (1)

“Good resolutions are simply cheques that men draw on a bank where they have no account.”

Oscar Wilde

It’s the start of a new year and some of us have managed to break our New Year’s resolutions (if we bothered to have some) long before we’ve received our January paycheck. As a friend of mine said: “It’s not worth the paper it’s not written on”.

If you are going to consider worthwhile New Year’s resolutions with respect to your approach to your savings and investment you may want to consider the following:

-

Let your investment policy statement be your guiding light. For some, that means actually creating an investment policy statement – a plan for your investment journey. For others, it may mean revisiting it at the start of the year to ensure it still reflects their goals and current needs. Either way, the key is to do it in a “vacuum” rather than in response to a market event. That helps take the emotion out of decision-making. After all, some of the investors who were most negatively impacted by the Global Financial Crisis and the pandemic were those who got out of markets when stocks started falling, only to miss out on substantial rebounds. Investment policy statements help investors, both institutional and individual, stay the course and keep focused on long-term goals. And if you can’t stick to your plan appoint an adviser who will help you do so – you’ll benefit in the long term.

-

Be well-diversified. For many investors, it’s not enough to just have exposure to stocks and bonds in your country of residence. It leaves out the potential benefits of global investments as well as alternative asset classes. And within all these major asset classes it’s important to be well-diversified. For example, within both equities and fixed income, many investors are under-exposed to emerging markets and may benefit from increased exposure. South African equities make up less than 1% of global markets, with other emerging markets representing over 12%. Don’t miss out on this opportunity.

-

Review your portfolio. Make sure you review your portfolio at least once a year. That enables you to make sure your investment still aligns with your long-term investment goals.

-

Be diligent with drawing up and sticking to a budget. This will help reach your long-term savings goals.

Speak to your trusted financial advisor who is best suited to help you implement these resolutions.

1. Source: Kristina Hooper, Chief Global Market Strategist, Invesco Ltd