Skip to content

Economic and Market Overview – February 2023

January 2023 In Review

-

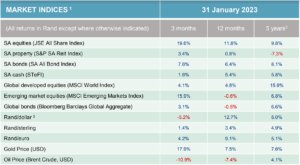

South African equity markets had a very strong rally and ended the month nearly 9% higher. This strong performance was led by Naspers, Prosus, and Richemont. Local bonds gained almost 3%.

-

Global markets also recovered strongly in January after a dismal 2022. The tech-heavy Nasdaq gained more than 10% in US Dollars while emerging markets ended the month nearly 8% higher. Tesla, whose share price lost almost 70% in 2022, bounced by 40% in January. At USD170 per share, it’s still far off its November 2021 high of USD414 per share.

-

After weeks of pressure, Germany has confirmed it will make 14 Leopard 2A6 tanks available for Ukraine’s war effort and give partner countries permission to re-export further battle tanks to Kyiv. This follows an announcement by President Joe Biden of the United States that they are readying more than USD2 billion worth of military aid for Ukraine, which is expected to include longer-range rockets for the first time as well as other munitions and weapons.

-

The 53rd World Economic Forum (WEF) Annual Meeting took place in Davos, Switzerland. According to the WEF Global Risk Report, global leaders are most worried about the cost-of-living crisis, natural disasters, and geo-economic confrontation over the course of the next two years. On a ten-year view, environmental risks such as the failure to mitigate and adapt to climate change are of greatest concern.

-

Eight countries in Europe recorded all-time high temperatures in January 2023, including Denmark, the Netherlands, Spain, and Latvia. These records usually increase by a few tenths of a centigrade, but Warsaw has seen a 4°C rise while in Bilbao in northern Spain, temperatures have been 10°C above average for the month. South Africa also experienced an extraordinary heatwave during the second half of January.

-

The South African Reserve Bank increased the official interest rate by 0.25%. This was lower than what the market expected and partly due to the Monetary Policy Committee’s expectation that load shedding will have a significantly negative impact on economic growth in the next three years. They expect 250 days of load shedding in 2023, 150 in 2024, and 100 days in 2025.

-

It’s been three years since Britain officially left the European Union on 31 January 2020. A creeping sense of Bregret is taking hold in Britain. The majority of Brits now say that the vote for Britain to leave the EU was a mistake. Only one in five think Brexit is going well – and seven in ten say that it has gone as badly, or worse than they feared. In the past year alone, there has been a ten-point swing toward rejoining the EU. Talk about buyer’s remorse…

-

France has seen several waves of protests and strikes against President Emmanuel Macron’s plans to raise the retirement age from 62 to 64. In a country where work is typically seen as a nuisance rather than a privilege, Mr. Macron’s government is pushing ahead with its pension age reforms. This is in the face of opinion polls that suggest two-thirds of voters are opposed to the changes. No surprise here either.

- Source: Factset

- All performance numbers in excess of 12 months are annualised

- A negative number means fewer rands are being paid per US dollar, so it implies a strengthening of the rand.

Page load link