*South African index returns are quoted in rands, while all other return figures are quoted in USD terms.

November was a great month for financial markets as there was a broad rally in both equities and bonds.

Global equity markets rallied hard in November, reversing losses compounded over the three prior months. The prospect of global central banks keeping rates “higher-for-longer” had been the key headwind to markets in the months leading up to November, when softer messaging from the US Federal Reserve (Fed) and the most recent US inflation data convinced most investors that they had become too pessimistic about the longevity of restrictive monetary policy.

The JSE All-Share Index returned 8.55% MoM in November with Naspers and Prosus being amongst the biggest winners on the JSE. The Industrials 25 Index which experienced the lowest return (-4.25%) among the major JSE indices in October 2023, experienced a notable reversal in November, posting the highest return at 10.47%.

The ALBI and the SA government’s ILB Index returned 4.73% and 4.83%, respectively in November, as core inflation (excluding food and energy) sustained its decline for the seventh consecutive month, printing at 4.4% in October 2023. This figure falls slightly below the midpoint of the South African Reserve Bank’s (SARB) target range of 4.5%. Given this context, the SARB maintained the repo rate at 8.25% during its final meeting for the year.

On the currency front, the South African Rand faced headwinds against major currencies in November, depreciating by 1.10% MoM against the US Dollar. Despite general weakness in the US dollar, the Rand was unable to capitalize on this trend.

Emerging Markets (EM) experienced a strong uptick in November with the MSCI Emerging Markets Index rising to 8.02% MoM. However, this gain was slightly behind developed markets. Egypt was the top performer in this index with Korea and Taiwan strongly benefitting from the rally in tech-related stocks.

The MSCI China USD Index was behind the EM index by returning 2.47% in November. This follows post investor concerns surrounding China’s economic recovery which continues to weigh heavily on sentiments.

The MSCI USA Index was up 9.43% in November. This follows as the US Federal Reserve kept rates unchanged at its November 2023 meeting.

This decision alleviated concerns among investors, who had previously been pessimistic about the duration of the restrictive monetary policy. This positive investor sentiment was further encouraged by the release of the US inflation data which highlighted more than expected cooling of prices.

After three consecutive months of losses, the US markets rallied in November, with the Big Tech stocks leading the charge. The Nasdaq 100 and the S&P 500 indices returned 10.82% and 9.13% MoM, respectively.

Other major markets, including MSCI Europe (9.89%), MSCI UK All Cap (7.40%), and MSCI Japan Index (8.56%), also delivered positive returns amid easing inflation pressures.

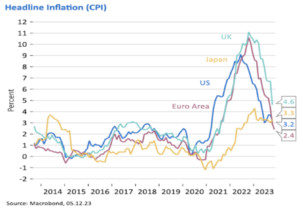

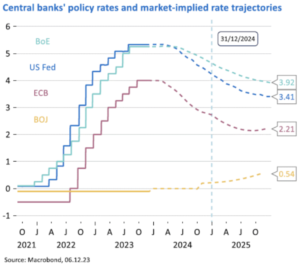

Furthermore, with inflation cooling more than forecast, and economic growth holding up, we believe that it is now more likely that rates will come down next year. Although we don’t expect rapid cuts, patience will still be required as the US Fed remains focused on developing data. Bond markets may also remain volatile, as every data release will likely cause a reaction. But as and when global bond yields come down to reflect lower inflation and cooling economic growth (induced by the US Fed), South African bonds are likely to follow them down at least to some degree, improving the return prospects for SA investors. The graphs below indicate how inflation is falling and the expected trajectory of interest rates into 2025.