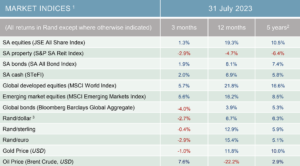

July 2023 In Review

-

In an update to their World Economic Outlook, the International Monetary Fund (IMF) upgraded their expectations for global economic growth in 2023 from 2.8% to 3.0%. This is still lower than the 21st century’s average of 3.8% but it’s an encouraging development nevertheless. The below-average growth is mainly driven by a slow-down in advanced, economies which are projected to expand by only 1.5% this year while emerging markets are expected to grow by over 4% in 2023.

-

The IMF summarises the positive forces shaping their outlook as follows: The global recovery from the COVID-19 pandemic and Russia’s invasion of Ukraine is slowing amid widening divergences among economic sectors and regions. The World Health Organization (WHO) announced in May that it no longer considers COVID-19 to be a “global health emergency.” Supply chains have largely recovered, and shipping costs and suppliers’ delivery times are back to pre-pandemic levels.

-

On the other hand, forces that hindered growth in 2022 persist. Inflation remains high and continues to erode household purchasing power. Policy tightening by central banks in response to inflation has raised the cost of borrowing, constraining economic activity. Immediate concerns about the health of the banking sector have subsided, but high-interest rates are filtering through the financial system, and banks in advanced economies have significantly tightened lending standards, curtailing the supply of credit. The impact of higher interest rates extends to public finances, especially in poorer countries grappling with elevated debt costs, constraining room for priority investments. As a result, output losses compared with pre-pandemic forecasts remain large, especially for the world’s poorest nations.

-

Closer to home, the Governor of the South African Reserve Bank (SARB) announced that they expect the South African economy to grow by 0.4% this year. This is an ever-so-slightly higher expectation than that of the IMF (0.3%) but against a required 3% to 5% growth rate that is required to address our unemployment conundrum it’s not encouraging at all.

-

The SARB’s Monetary Policy Committee decided to leave South Africa’s official lending rates unchanged following their meeting in July. This follows a return of inflation (5.4% in June) to within their target band of 3% to 6%.

-

In the United States, the Federal Open Market Committee (FOMC) decided to increase their official rate by another 0.25% to 5.25% – the highest level in 22 years. The European Central Bank’s Governing Council decided to raise their official rates by 0.25% and the Bank of England, with their 14th consecutive increase, also moved their interest rates up by 0.25%. In all these instances the risk is that central banks keep on tightening monetary policy beyond what was required to tame inflation and that developed economies will experience a higher-than-expected slowdown in growth.

-

Europe’s Aeolus satellite returned to Earth after 5 years of near-orbit exploration. This British-built spacecraft’s mission was hailed a success for the novel data it provided to weather forecasters looking several days ahead. It was dubbed “the impossible satellite” as engineers struggled for over a decade to develop an instrument that would operate for long enough in the vacuum of space. It was worth the perseverance though – it gave the first truly global view of what the winds on Earth are doing, from the surface all the way up into the stratosphere.

Market Performance

South African equities had a strong month as the JSE’s All Share Index ended 4.0% higher. Financials lead this performance as the sector index added nearly 8% in July. Retailers (up 12.1%) also gave the local market a strong leg up.

Global equities added 2.8% in US dollar terms, but for South African investors this was offset by a nearly 6% weakening of the greenback against the South African rand.

Visio Capital, in their latest market and economic update, reports that local bonds (up 2.3% in July) recorded another strong month supported by lower-than-expected inflation, an unchanged policy rate, and the strength of the rand versus its basket of global trading currencies.

- Source: Factset

- All performance numbers in excess of 12 months are annualised

- A negative number means fewer rands are being paid per US dollar, so it implies a strengthening of the rand.

Did you know?

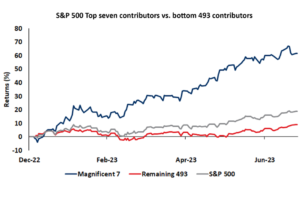

US Equity returns have been driven by a very concentrated number of stocks this year. This chart from Momentum Global Investment Management shows the market capitalisation (market-cap) weighted performance of the largest seven contributors to the S&P 500 Index’s overall performance compared to the market-cap weighted performance of the remaining 493 companies. Given that the S&P 500 is a market-cap-weighted index, the impact that one stock has on the performance of the overall index is proportional to the size of that stock’s market-cap. So far this year, a small selection of the index’s largest stocks by market-cap have also seen some of the best returns so far, resulting in a disproportionate contribution to the S&P 500’s return from a small number of stocks. The ‘Magnificent Seven’, consisting of Apple, Microsoft, NVIDIA, Amazon, Meta, Tesla, and Alphabet, have returned 61% so far this year. The other 493 stocks in the index have not performed nearly as well, returning just 9% year-to-date (YTD). However, the structure of the S&P 500 index means that with the largest stocks performing so well, the index (as a whole) has returned 18.6%, with the seven top-performing stocks accounting for two-thirds of the index’s gains, indicating an extreme lack of breadth in the strong performance of the US equity market so far this year.

Source: Momentum Global Investment Management, Factset