Economic and Market Overview

Global

The 26th United Nations Climate Change Congress of the Parties (COP26) has focused the world’s attention on the initiatives required to slow down global warming.

The overarching goal of the conference is to put measures in place to limit the global temperature increase to less than 1.5˚ Celsius by reaching “net zero” by 2050. This implies that, by the second half of the century, we should be producing less carbon than we consume from the atmosphere. This ambitious target will have far-reaching implications for investment strategies as trillions of dollars of capital will be re-allocated to enable (and benefit) from this structural change in the way in which energy will be generated in decades to come. There are, however, 50 shades of green, and investors will do well to discern between investments that make a significant contribution towards a net-zero target and those that are “green-washed” merely to attract capital.

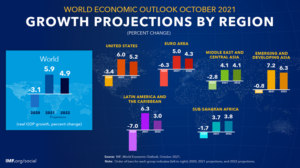

Coming back to more recent events, it is encouraging to see that the global economic recovery is continuing, even as the pandemic resurges in parts of the world. According to the latest World Economic Outlook, published in October by the International Monetary Fund, the global economy is projected to grow by nearly 6 percent in 2021 and just under 5 percent in 2022. These average growth expectations hide a lot of important detail though. The fault lines opened up by COVID-19 are looking more persistent—near-term divergences are expected to leave lasting imprints on medium-term performance. Emerging and Developing Asia (still dominated by China’s economic growth) lead the recovery, and in 2020 had also not contracted to the same extent as other parts of the world. This relative economic outperformance has moved global economic power further (and faster) towards the east:

Many countries have announced multi-decade infrastructure spending plans to not only fast track the move to a greener global economy but also to create employment opportunities that can replace those permanently lost during the pandemic. The sustainability of COP 26’s initiatives will also depend on its economic benefits. This will make policy choices even more difficult as political and environmental agendas are balanced with returns required on capital invested. It’s a watershed moment either way –unchecked warming of the planet is simply not an option.

South Africa

South Africa’s run-up to local elections dominated much of the news flow in October. Voter turnout was more than 20% lower than during the 2016 municipal elections which reflect South Africans’ increased disillusionment with the ability of politicians to deliver on their electioneering promises.

The ruling ANC’s national support dwindled from 53.9% in 2016 to 46.0%. Similarly, the Democratic Alliance saw a reduction in support from 26.9% to 21.8%. Notable gains on a national level were made by the Economic Freedom Fighters (from 8.2% to 10.4%), Inkatha Freedom Party (4.3% to 5.7%), and the Freedom Front Plus (0.8% to 2.4%)¹. Much has been made by the opportunities for economic growth on a local council level if allocated funds were spent wisely (if at all). The challenge, however, is that no party has reached an outright majority in many of the large metropoles (including Johannesburg, City of Tshwane, Ekurhuleni, and Nelson Mandela Bay), and coalition governments are not renowned for quick decision-making and subsequent implementation of much-needed infrastructure development and proper service delivery. These results did not come as a surprise though, which means that it’s already reflected in the share prices of companies affected by the local economy. Any positive surprise should benefit the performance of not only the so-called large-cap “SA Inc” companies (banks, insurers, retailers, and food producers) but also many of the small to medium capitalisation companies whose fortunes very much depend on local economic conditions.

According to the IMF’s World Economic Outlook report, the expected growth rate for South Africa is 5% in 2021, moderating to 2.2% in 2022. This clearly lags behind the rest of the world, developed and emerging markets alike. South African economic data for August (released in October) shows some recovery post the July riots, but overall economic activity is likely to have slowed in the third quarter (compared with the previous quarter). Visio Capital reports that mining activity disappointed and while manufacturing production rebounded in August it registered lower activity than June. Retail sales were also weaker, possibly pointing to damage to consumer confidence. However, the back payment of the R5 000 cash gratuity to 1.2m public sector employees agreed to in the wage settlement to be paid in September is likely to support the sector into the last quarter of the year.

economic activity is likely to have slowed in the third quarter (compared with the previous quarter). Visio Capital reports that mining activity disappointed and while manufacturing production rebounded in August it registered lower activity than June. Retail sales were also weaker, possibly pointing to damage to consumer confidence. However, the back payment of the R5 000 cash gratuity to 1.2m public sector employees agreed to in the wage settlement to be paid in September is likely to support the sector into the last quarter of the year.

While forward-looking, indicators such as the Reserve Bank’s leading indicators index and PMIs are pointing to a resumption in the upward momentum in growth in the next few quarters. Renewed power outages are a sad reminder that any uptick in growth is temporary, and the pre-pandemic low growth environment will return in 2022 as promises of policy reforms are likely to remain just that.

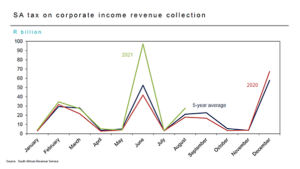

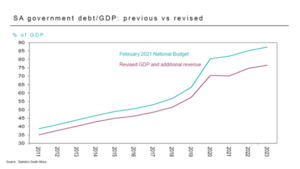

It’s not all bad news though. Tax receipts have surprised on the upside as soaring commodity prices lead to outsized profits for basic materials companies. This, accompanied by a lower than expected debt to GDP ratio following the economic lockdown augurs well to pique the interest of foreign investors:

Lastly: South Africa’s rate of vaccinations has held steady over the last few months. With adequate supply available and 40% of the adult population inoculated the chance of another serious lockdown diminishes by the day, with a commensurate brighter expectation of a sustained economic recovery.

Market Performance

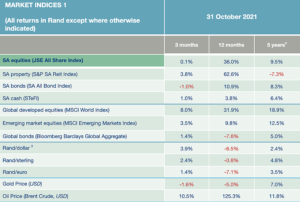

Global equities again rallied hard in October, posting strong gains across the board. This was especially notable in the US where the S&P 500 gained 7%, while the MSCI World Index posted a return of 5.7% (both in US dollars).

Emerging markets (0.9%) lagged materially as higher inflation is likely to drive a more aggressive interest rate hiking cycle. This is quite evident already by the fact that 11 central banks in emerging economies have hiked their policy rates in October.

Visio Capital reports that South African equities followed global developed markets. Local equities (+5.2%) performed materially better than their emerging markets peers as the resources sector recovered some of its previous month’s losses.

performed materially better than their emerging markets peers as the resources sector recovered some of its previous month’s losses.

The factors behind this risk-on sentiment returning to equities were subtle. Laurium Capital reports that there was no significant improvement in the precarious Evergrande debt position, nor reason to worry less about global inflation triggers, rising Covid cases in many Northern Hemisphere countries, and supply chain disruption. However, there were no real negative surprises in any of these areas. As a result, investors focused once again on pent-up demand from the past eighteen months of suppressed economic activity, and corporate profit growth exceeding high expectations. The reopening of transatlantic air travel by the US gave new impetus to the expectations of a return to “normality”. Chinese technology shares regained some luster in the absence of any new regulations.

The rand weakened only marginally against the major developed market currencies and, as was the case with local equities, outperformed its emerging market counterparts during the month.

1. Source: Factset

2. All performance numbers in excess of 12 months are annualised

3. A negative number means fewer rands are being paid per US dollar, so it implies a strengthening of the rand.

Commentary – A Twist In The Tale

A villain turned hero – aren’t those just the most wonderful stories? In a South African context, there are few more hated entities than Eskom. They introduced load shedding more than a decade ago and have since not covered themselves in glory. Their inability to secure reliable energy has cost our economy billions of rands in growth and has certainly not bolstered the confidence of potential local and foreign investors to deploy the capital our economy so sorely needs. In this story, they are our villains. At least for the moment.

Blackrock’s investment institute recently published a research paper that argues how to finance the transition to net-zero (putting in no more carbon into the atmosphere than we’re taking out) in emerging markets in particular. They state that Emerging markets (EMs) are essential to the global transition, now accounting for 34% of global carbon emissions (excluding China), but they are starved of capital to fund it. They estimate that EMs will need at least USD 1 trillion per year to achieve the net-zero target by 2050. This is more than 6 times the current investment. In support of these capital investments, the United Nations have set a target of USD 100 billion to be mobilized by developed countries that, in turn, will be leveraged to the required investment of USD 1 trillion of public and private capital. In short – there is a whole lot of money coming the way of emerging markets.

state that Emerging markets (EMs) are essential to the global transition, now accounting for 34% of global carbon emissions (excluding China), but they are starved of capital to fund it. They estimate that EMs will need at least USD 1 trillion per year to achieve the net-zero target by 2050. This is more than 6 times the current investment. In support of these capital investments, the United Nations have set a target of USD 100 billion to be mobilized by developed countries that, in turn, will be leveraged to the required investment of USD 1 trillion of public and private capital. In short – there is a whole lot of money coming the way of emerging markets.

This is where the opportunity lies for Eskom to redeem itself. In a recent editorial Business Day argues that, at COP26, the team from South Africa is charting a path for which SA, and perhaps even other countries in the world, will be grateful. While there is much to be done at the UN Climate Change Conference before we can venture to call it a success, SA’s landmark climate finance deal has helped the gathering get off to a positive start. Thanks to the foresight of the team at Eskom, the work had been done well in advance of the conference and SA stood out from the crowd in that it had a plan to put on the table.

For their part, developed countries are anxious to be seen to be doing something. Their citizens are mobilised and intent on getting their governments to address the climate change problem. Promises to mobilise the USD 100 billion a year to support developing countries have fallen badly short to date. COP26 presented a moment of unprecedented opportunity for this reason and to their credit, President Cyril Ramaphosa and his environment minister Barbara Creecy grabbed it and used it well. As well as having the groundwork done by Eskom to draw on, they were strongly encouraged by an active Presidential Climate Commission, chaired by former cabinet minister Valli Moosa, as well as activist groups which have done effective work to awaken government and corporate SA to the climate issues.

While there is much optimism right now, it is worth keeping in mind that SA’s energy transition is a huge task. Up to 85% of SA’s energy is generated from coal and the country is the world’s 12th-largest emitter. To make the transition, Eskom, which owns and runs the national transmission grid, requires enormous investment. This is to enable new connections of renewable energy generation, whether privately owned or public.

The grid in the Northern Cape, the optimal part of the country for solar energy generation, is saturated, energy officials have said. After the latest round of projects, announced last week, there will be no space for additional connections. Decommissioning plants is costly. Eskom wants to build renewable energy so that its staff will be employed after the transition and the company will still receive revenue. The $8.5bn commitment (about R130bn at current exchange rates) which is anticipated will be comprised primarily of loan funding at close to zero interest rates. This, however, is only a portion of what Eskom will need to make the transition. CEO André de Ruyter says the requirement for Eskom alone is in the region of $35bn to $50bn.

Commentary – A Twist In The Tale (continued)

As well as the costs of transitioning to different forms of generation, the entire Mpumalanga highveld is built on coal, with most mines situated in the vicinity, on top of which sit Eskom coal power stations. When mines and power stations close or are repurposed, it is not only the 100,000 or so people who work in these sectors who are affected but entire towns, which will be left stranded. As the whole of South Africa benefited from the energy these communities generated, it is the entire country’s responsibility that the transition is a just one.

This is the attraction of the Eskom plan. While it aims to retire 22GW of coal by 2025, it also provides the world with a template on how to do it. When the climate envoys from the UK, US, France, and Germany visited South Africa in September, Eskom was able to demonstrate to them what it planned to do. Its showpiece at Komati, an aged coal power station that is being repurposed to generate renewable energy, would have played a part in their persuasion.

Komati is being converted to a small-scale pilot Agri-voltaic plant where tall gantries will support solar panels while the land beneath will be used to cultivate crops. The solar plant will be supported with battery storage. The warehouses at Komati are also being converted to house fabrication and assembly plants for microgrids and Eskom is investigating how to make use of the generator sets and the turbines to repower other parts of the plant with gas.

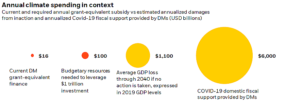

It is plans like these that are sorely needed in emerging markets. The COVID-10 pandemic certainly got the world into action as it had an immediate economic impact. Not acting to drive climate change will have much more of a long-term impact and one can only hope that the world’s leaders will have the vision to act. The graph below (courtesy of Blackrock) shows how COVID-19 fiscal support dwarfs the current contribution of developed markets to the energy transition in emerging markets:

long-term impact and one can only hope that the world’s leaders will have the vision to act. The graph below (courtesy of Blackrock) shows how COVID-19 fiscal support dwarfs the current contribution of developed markets to the energy transition in emerging markets:

In time the funding will be provided. It is likely that innovative plans (such as the Eskom one) will be first in line to receive and deploy developed market capital. While Eskom is probably our most hated corporation, due to tariff increases and load-shedding, it is also a company charting a path for which South Africa, and perhaps even other countries in the world, will be grateful. And in the process, our biggest villain may just become one of the heroes in the story of South Africa.

Sources: “The big emerging question” – Blackrock Investment Institute

“Team SA stands out in the Glasgow crowd” – Business Day 2021/11/04