Skip to content

Marketing Report: December 2025 in Review

December 2025 In Review

From Fear to Recovery

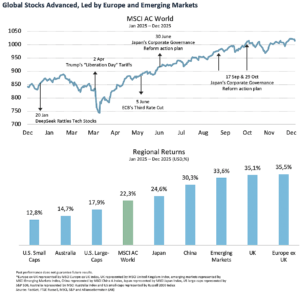

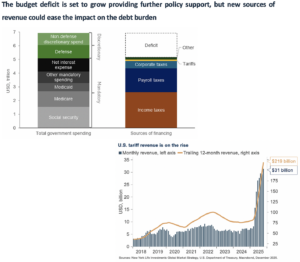

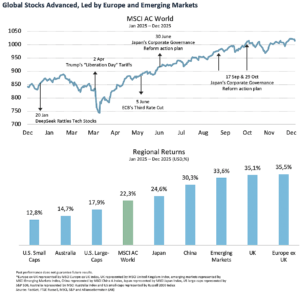

2025 opened with renewed anxiety as US tariffs reignited global trade tensions, triggering a sharp sell-off in equities. By early April, developed markets were down 16.5%, and recession fears briefly dominated sentiment. As the year progressed, however, fiscal support increased and central banks remained accommodative, allowing markets to stabilise, recover and ultimately deliver strong gains by year-end.

A More Selective Equity Rally

US equities spent much of the year driven by enthusiasm around artificial intelligence, particularly in technology and communication services. Over time, leadership narrowed as investors focused on fundamentals rather than broad tech exposure. Outside the US, a weaker dollar boosted returns, while value stocks outperformed growth, reinforcing the benefits of geographic and style diversification.

Bonds Behave, Metals Dominate

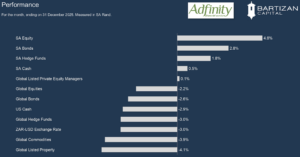

With inflation fears fading and policy rates peaking, bonds delivered a quietly strong year. Attractive starting yields and rate cuts supported returns across developed markets, while emerging market debt stood out. Precious metals were the clear standout asset class: gold benefited from central bank demand, while silver surged on industrial and electrification themes, lifting commodity returns despite weaker oil prices.

South Africa Ends on a High

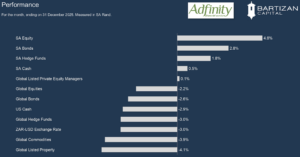

South African equities capped an exceptional year with strong December gains, led by gold and platinum miners and a recovery in banks and insurers. Improving macro fundamentals, easing inflation and a record trade surplus supported the rand and reinforced expectations that interest rates are near their peak, enhancing the appeal of local bonds offering attractive real yields.

A Year of Cross-Currents and Surprising Resilience

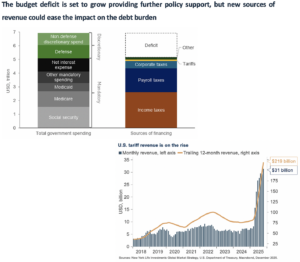

Markets didn’t make it easy in 2025. The year started with a familiar mix of anxiety and headlines, as trade tensions flared after the US raised tariffs to levels not seen since the 1930s. Investors reacted quickly – and sharply. By early April, developed market equities were down 16.5%, and it briefly felt like the market was bracing for something much worse.

Then, as often happens, the narrative shifted. The second half of the year brought a clearer focus on what actually matters for markets: policy support and liquidity. Fiscal spending picked up, central banks stayed accommodative, and investors gradually leaned back into risk. The result was a broad-based rally that lifted almost everything. By year end, developed market equities had not only recovered but finished up 21.6%, and 2025 became the first year since the pandemic where every major asset class ended in positive territory – a timely reminder that markets have a habit of climbing walls of worry.

Broad-Based Gains Beyond the United States

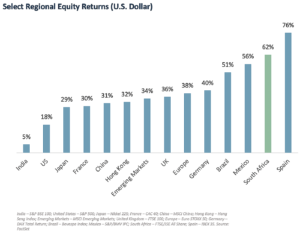

US equities spent most of 2025 riding the AI wave. Enthusiasm around artificial intelligence powered the communication services and information technology sectors, which returned 33.0% and 23.6% respectively. But as the year went on, investors became far more selective. The trade stopped being about “owning tech” and started being about owning the right tech. In the end, only two of the so-called Magnificent Seven managed to beat the broader S&P 500. Meanwhile, consumer-facing sectors struggled. Slower job growth and cautious consumers weighed on sentiment, keeping pricing power in check. That helped avoid an inflation flare-up, but it also capped returns. US equities finished the year up a respectable 17.9%, though that was enough to make 2025 the first year in two decades where the S&P 500 was the weakest major equity market.

Outside the US, the story was stronger. A sharply weaker dollar changed the scoreboard, turning solid local returns in Europe into standout gains for sterling- and euro-based investors. Style leadership also broadened – growth dominated in the US, value led elsewhere – and at the global level, the two ended the year almost neck and neck. Another quiet reminder that diversification still does its job.

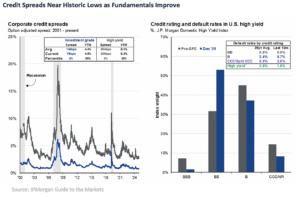

Bonds Benefit from Rate Cuts and Currency Support

Bonds quietly had a very good year in 2025 – something that would have sounded unlikely not long ago. Inflation fears faded as the much-anticipated tariff-driven price spike never showed up, giving central banks room to continue normalising policy. With yields starting the year at attractive levels and the US dollar weakening, global bonds delivered a respectful 8.2% return in US dollar terms.

Government bond performance varied by region. US Treasuries led the pack in local currency terms, returning 6.3%, helped by 75 basis points of Federal Reserve rate cuts in the second half of the year. UK Gilts weren’t far behind, supported by high starting yields and rate cuts from the Bank of England. Europe was more complicated – peripheral markets outperformed, while French bonds struggled amid political turmoil. German and Japanese bonds lagged as higher spending expectations pushed yields higher.

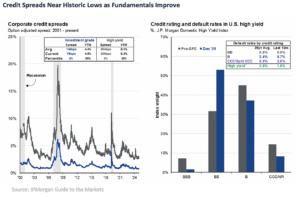

Credit markets leaned into the risk-on mood. Spreads tightened, returns improved, and emerging market debt stood out with gains of 13.5%, boosted by strong fundamentals and favourable currency moves, particularly across Latin America.

Precious Metals Take Centre Stage

If there was one place investors didn’t need to squint to find returns in 2025, it was precious metals. They were the clear standout asset class of the year, with the Bloomberg Precious Metals Index up an eye-catching 80.2%. Gold once again reminded investors why it sits at the centre of the financial system. Ongoing purchases by international central banks, keen to diversify reserves away from the US dollar, provided a steady source of demand, while gold ETFs saw renewed inflows as investors looked for portfolio insurance in a year filled with policy shifts and geopolitical noise. But the real fireworks came from silver. Often more volatile and tied to industrial demand, silver rode the AI and electrification themes to exceptional gains, finishing the year up 149.1% and comfortably outperforming gold.

These strong performances more than made up for weakness elsewhere in the commodity complex. Falling oil prices weighed on energy markets, but precious metals carried enough weight to lift overall commodity returns to a respectable 15.8% for the year – another reminder that diversification works in unexpected ways.

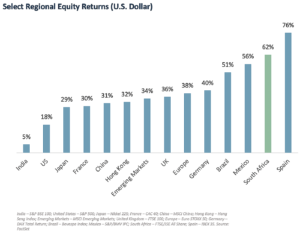

December Delivers a Strong Finale for South African Equities

December was a fitting finale for an exceptional year on the JSE. South African equities outperformed every major global market for the month, with the FTSE/JSE All Share index up 4.5%. In US dollar terms, the JSE delivered a remarkable 62% return in 2025 – second only to Spain among major bourses.

The heavy lifting again came from precious metals. Gold and platinum miners accounted for roughly 60% of the market’s gains this year, riding powerful moves in underlying prices. Platinum stood out in December, surging 23% and pushing platinum miners up 16% for the month. Easing EU policy around combustion engines and the launch of China’s first platinum futures contract have reignited enthusiasm around future industrial demand.

December also brought a welcome shift toward domestic cyclicals. Banks jumped 10% and insurers gained 5%, helping offset ongoing weakness in retailers, where discretionary names closed out a difficult year deep in the red.

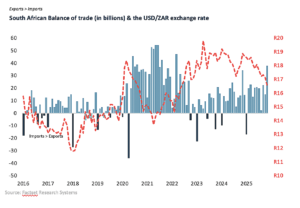

Macro Tailwinds Strengthen the Case for South African Fixed Income

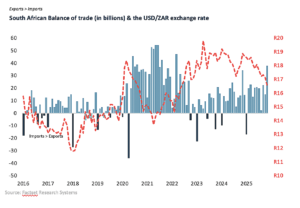

South Africa’s macroeconomic backdrop continued to improve into year-end, supporting local fixed income assets. Headline inflation eased to 3.5% in November, remaining comfortably within the SARB’s target band, while a record R37.7bn trade surplus underpinned external balances and helped the rand appreciate meaningfully in 2025.

These developments reinforce the view that domestic interest rates are at or near their peak. With inflation contained and growth risks balanced, SA bonds continue to offer attractive real yields relative to global peers. Improving sentiment toward SA Inc., firmer currency dynamics and supportive commodity prices further enhance the appeal of local fixed income for investors seeking yield and stability.

Page load link