Skip to content

Marketing Report: August 2025 in Review

August 2025 In Review

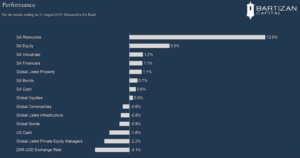

In August, global equities advanced, with the MSCI All Country World rising 2.5% and the Bloomberg Global Aggregate Bond Index gaining 1.5%. Earnings season also provided a lift: Nvidia beat overall expectations despite a miss in data center revenues, while roughly three-quarters of S&P 500 companies outperformed forecasts, marking the strongest positive surprise since 2021.

Macro data drove much of the market action. U.S. non-farm payrolls indicated a cooling labour market, prompting Jerome Powell at Jackson Hole to suggest that risks now tilt toward policy easing. Futures markets quickly priced in a September Fed rate cut. Political drama added colour, as President Trump dismissed the head of the Bureau of Labor Statistics and sought to remove Fed Governor Lisa Cook, though financial markets reacted only mildly. Precious metal prices gained on fear of higher US inflation, and industrial metals declined due to weaker Chinese manufacturing activity and inventory overhang.

Dollar weakness continued, and the Dollar lost 3.1% against the SA rand during August. Gold miners, GoldFields and AngloGold, rose 31.5% and 19.4% respectively for the month. Pushing the local resource sector higher, and as a result lifting the JSE All Share to a new all-time high.

Page load link