Skip to content

Marketing Report: March 2025 in Review

March 2025 In Review

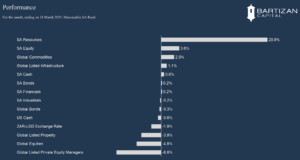

In March 2025, markets experienced notable movements driven by policy uncertainty, increased geopolitical tensions and growth concerns in the United States. Global equity markets experienced a challenging month, with the MSCI All Country World Index (ACWI) declining by 4.0%. The United States markets were the primary contributors to this downturn, as the S&P 500 fell by 5.8% during the month, marking its worst quarter since 2022. Technology and consumer discretionary sectors were particularly hard-hit, with losses of 8.3%. On the other hand, Chinese technology companies, buoyed by advancements in artificial intelligence, saw significant gains, including Alibaba (+55.1%) and Tencent (+19.0%).

In global fixed income markets, a “flight to quality” was observed, with investors favoring safer assets like United States Treasuries and G7 government bonds, which rallied during the month. Credit markets, including investment-grade and high-yield bonds, showed resilience, delivering small positive returns despite broader market volatility.

Commodity markets displayed mixed performance. Precious metals like gold and silver saw gains, driven by increased demand as safe-haven assets amid geopolitical tensions. Copper prices also strengthened, supported by robust industrial demand. However, energy commodities such as crude oil experienced a decline, reflecting concerns over global economic growth.

Dollar weakness continued during the month, and the Rand-Dollar exchange rate ended the month at R18.32 to the Dollar. The South African resource sector was up by 20.9%, driven by gold and platinum mining companies.

Page load link