Skip to content

Marketing Report: September 2024 in Review

September 2024 In Review

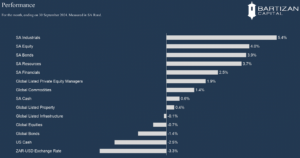

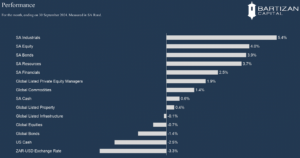

Global Equities rose by 2.3%, in US Dollars, during September. As expected, at the September 2024 Federal Open Market Committee (FOMC) meeting, the Federal Reserve (Fed) lowered interest rates by 0.50%, easing monetary policy for the first time in four years. This lowers the interest rate target to a range of 4.75% to 5.00%. A couple of days later, the South African Reserve Bank (SARB) slashed its key interest rate by 0.25% to 8.00%, following seven consecutive meetings at a 15-year peak of 8.25%. This marks the SARB’s first policy easing since the pandemic in 2020, as price pressures cooled. Following the smaller rate cut in South Africa than the US cut, the Rand gained 3.3% against the greenback during September, reducing the Dollar gains on most offshore investments for local investors.

During the last week of the month, China’s central bank finally stepped in to stimulate the Chinese economy. In its boldest intervention to boost the economy since the COVID-pandemic, the People’s Bank of China adopted a suite of measures to reduce borrowing costs, by cutting interest rates on existing mortgages by 0.50% and reducing the level of reserves banks must set aside before making loans. Investors reacted positively to the news, and the Chinese equity market rose by almost 24% in US Dollar terms by the end of the month.

South African equity and bonds markets performed strong during September. Industrials was the best performing sector of the local market, with clothing retailers (Mr Price, Pepkor & Truworths) and healthcare providers (Life Healthcare & Netcare), all reporting double digit gains for the month.

Page load link