Skip to content

Marketing Report: August 2024 in Review

August 2024 In Review

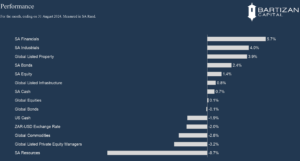

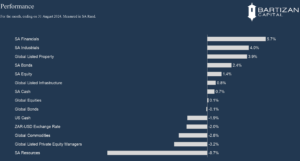

Global equities experienced a rollercoaster month during August. Weaker economic data from the US, and a surprise interest rate hike in Japan, caused markets to decline by more than 6% during the first week of the month. After markets digested the news, it slowly recovered over the remainder of the month and ended the month with a positive return. The US Federal Reserve Chair, Jerome Powell’s speech at Jackson Hole provided investors with a clear indication that the Fed is ready to cut interest rates. As a result, rate-sensitive asset classes, like Listed Property and Listed Infrastructure rallied during August.

Brent oil traded above $83 per barrel halfway through the month but then fell to $76 at month’s end. As a result, the broad commodity index was one of the weaker asset classes for the month. Listed Private Equity Management Companies also experienced a loss during August.

August was another strong month for South African equity and bonds markets. Financials and Industrial were the top performing segments of the local equity market, and local bonds also posted strong gains on the back of a strong local currency. Gold and Platinum miners were the major laggards on the local equity market during August.

Page load link