August 2023 In Review

-

Local economic data for the second quarter in August was mixed. Mining and manufacturing surprised on the upside, while economic activity in Retail Sales came in lower than expected. Overall, economic activity in South Africa continues to rally against the prognosticated slump at the beginning of the year resulting from ongoing power cuts and worsening logistical bottlenecks, particularly regarding railway transportation. Compared to the same period last year, the economy is up 1.6%. As of the second quarter, the economy has grown by 0.9%, some way ahead of the Bloomberg consensus forecast of 0.3% for the whole of 2023. The positive outcome against market estimates clearly suggests the presence of an underlying resilience in the economy despite the purported slump from load-shedding and other structural impediments.

-

In August, central banks in developed and emerging economies slowed their interest rate hikes due to uncertain growth prospects and inflation concerns. Only four out of the ten most traded currencies’ central banks held rate meetings. Norway and the United Kingdom each increased rates by 0.25%, while Australia and New Zealand kept rates unchanged. This marked a decrease from the three rate hikes across six meetings in July. Given persistent inflation, it’s unlikely that central banks will cut rates with any sense of urgency soon.

-

The ratings agency Fitch downgraded the US Treasury credit rating from AAA to AA+. They cited a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters, notwithstanding the June bipartisan agreement to suspend the debt limit until January 2025. The repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management. According to commentators, this step is however unlikely to act as a valuation driver or disrupt the functioning of the US Treasury market. Fitch already had the US AAA credit rating on a negative watch and is now the second major rating agency to downgrade the US to an AA+ rating, after Standard & Poor’s.

-

The 15th BRICS summit was held in Johannesburg and culminated with the announcement that Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the UAE have been invited to join the contingent. BRICS countries have economies vastly different in scale and governments with often divergent foreign policy goals, a complicating factor for a bloc whose consensus decision-making model gives each member a de facto veto. Bloc heavyweight China has long called for an expansion of BRICS as a means of fostering a multipolar world order to challenge Western dominance.

-

Lastly, back to the local front. The impact of slow structural reforms on the economy is re-emerging in government finances. After being bailed out by strong commodity prices in the previous two fiscal years, the most recent data points to a worse outcome than budgeted for by the National Treasury in February. Tax revenue collection is lower and government expenditure higher than anticipated pointing to a meaningfully larger budget deficit than anticipated.

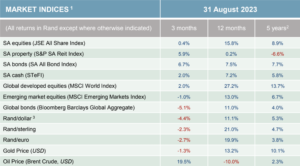

Market Performance

Global markets pulled back in the month of August as economic growth moderated, and inflation remained stubbornly high. Given the slower-than-anticipated decline in inflation around the world central banks are likely to keep interest rates at current levels for longer. Emerging market equities gave up nearly 5% (in US dollars) while developed equity markets shed nearly 2%. China (-6.2%), in particular, had a tough month as the recovery (from the opening up of the economy post-COVID-19) seems to have stalled.

Among shares listed in South Africa, resource counters suffered the most and ended the month nearly 10% lower. Combined with Prosus losing 7.3%, this dragged the local market down by almost 5% in August. The bond market also trended somewhat lower, as rising yields led the market down by 0.2% during the month. Property weathered the storm better than most other asset classes and gained 0.9% in August. However, it is still a laggard over longer periods as the effects of the economic lockdown and rising interest rates wash out of performance.

Gold (down 1.6% in US Dollars) and Brent Crude Oil (up 1.5%) didn’t move much during the month but the oil price is up by almost 20% over the last three months. This will hamper the downward movement of global inflation as energy prices start to rise again.

- Source: Factset

- All performance numbers in excess of 12 months are annualised

- A negative number means fewer rands are being paid per US dollar, so it implies a strengthening of the rand.

Did you know?

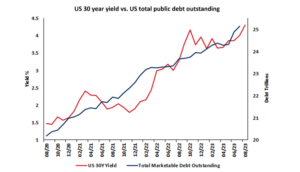

This chart illustrates the trends in US 30-year treasury yields over the last three years compared with the total outstanding US public marketable debt, highlighting how the rise in yields aligns with an increase in public borrowing. Over the last week, the yields on these bonds climbed to the highest levels seen this year, reaching 4.32% following concerns regarding the trajectory of US debt leading to a credit ratings downgrade enforced by Fitch, and an announcement by the Treasury of an increase in borrowing in Q3. This is only the second ratings downgrade ever, after the S&P global ratings agency’s downgrade in 2011, and has put the spotlight back on the USA’s worsening fiscal outlook. Bonds are rated by assessing the financial strength of issuers such as governments and corporations, ranking their ability to meet debt payments. These ratings are often used by investors when allocating risk in a portfolio and determine how much interest a borrower pays when raising funds in capital markets. The change from AAA to AA+ comes following the introduction of tax cuts and new spending initiatives, alongside a number of economic shocks that have contributed to a US debt burden that is projected to reach 115% of Gross Domestic Product by 2025. Furthermore, several political standoffs concerning the US debt ceiling have prompted a reassessment of policymakers’ commitments to address the country’s sizeable and increasing debt. The downgrade now means that Fitch no longer regards US credit, often seen as the world’s risk-free asset benchmark, to be of the highest quality.

This is important because US treasuries play a pivotal role in global markets and have long been a cornerstone of investor’s portfolios due to their widely acknowledged safe-haven status. As a benchmark for risk-free assets, they impact interest rates and investment decisions worldwide. Consequently, the finances of the US and fiscal trajectory directly influence investors’ perception of risk and the government’s ability to service its debt, and therefore can have large impacts on the demand and pricing of US treasuries. Since Fitch’s decision last week, many have dismissed the verdict as irrelevant and unnecessary. Critics including the Treasury Secretary Janet Yellen have pointed to the resilience of the US economy, with growth so far this year surprising to the upside and the resolution of the US debt ceiling debate, arguing that the US’s ability to make a repayment on its debt remains unquestionable. Prominent investors such as Jamie Dimon and Warren Buffet, have similarly downplayed the significance of the news, stating that Fitch’s statement provides markets with no information that is not already priced into markets and that US treasuries remain the preferred asset haven of choice. Whilst US fixed-income markets experienced sell-offs last week, these were also attributed to a ramp-up of bond sales to fund the widening budget deficit, rather than solely being a response to the ratings change. While it is important for investors to monitor the government’s handling of US finances, what is currently likely to have more of an impact on bond rates is the shifting outlook for economic growth, inflation, and interest rates. The US always expects to be number one, so whilst the ratings downgrade is not likely to have a lasting impact on markets, it may have rattled the nation’s pride and also provides fuel for political debates in the upcoming elections.

Source: Momentum Global Investment Management, Bloomberg Finance L.P. Data to 31 August 2023.