Skip to content

Economic and Market Overview – April 2022

Economic and Market Overview

April 2022

Global

Global news in the first quarter of 2022 was overshadowed by the events in Ukraine, which caused major moves in financial markets around the world.

Commodity prices exhibited extreme volatility which spilled over into equity and bond markets. Looming large over this macro-shock overload was the US Federal Reserve, seemingly late to the anti-inflation party but, as they say, “better late than never”. According to Laurium Capital, the Federal Open Market Committee (FOMC) decision in favour of only an initial 25 basis point US rate hike at the March meeting seemed palatable for nervous investors, but the announcement was followed by a raft of hawkish Fed comments and forecasts for the future path of US interest rates. With surging energy and food prices further exacerbating the post-Covid supply chain shocks of 2021, goods inflation has indeed reached significant, multi-decade peak levels, and forced even the most sanguine of investors to reflect on the likelihood of more sustained second-round inflation in the year to come. As a result, bonds sold off, reflected in the US 10-year yield rising to over 2.55% late in March, before retreating somewhat to 2.34% at month-end. The German 10-year equivalent yield moved up by more than 80bps in the month.

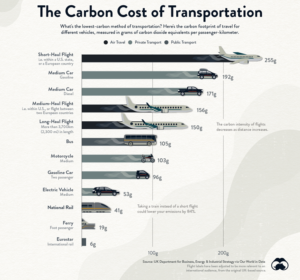

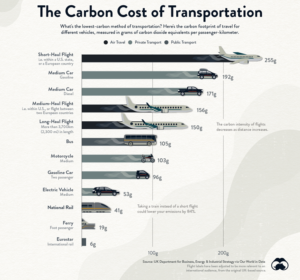

Aside from the events in Ukraine and inflation fears, the move to greener energy s enjoying increasing attention. The Intergovernmental Panel on Climate Change (IPCC) recently published a report that found that average annual global greenhouse gas emissions were at their highest levels in human history between 2010 to 2019, but the rate of growth of emissions has since slowed. One of the ways the world’s population can help to slow emissions is to make better choices in terms of transport. The infographic below shows how each type of transport contributes to the emission of CO2:

South Africa

The South African Reserve Bank’s Monetary Policy Committee (MPC) decided to increase the repurchase rate by 0.25%, taking it to 4.25%.

Once again, this move was not unexpected and matched the guidance given by the Governor of the Reserve Bank in previous Monetary Policy Committee (MPC) statements. What was surprising is that two members of the MPC voted in favour of a 0.5% increase in the rate – the first time in four years that any member of the committee voted for such a large increase.

The MPC’s inflation forecast for 2022 was raised by 0.9% to 5.8% due primarily to a material increase in the price of fuel and, to a lesser degree, food. While food prices will stay high, fuel price inflation should ease in 2023, helping headline inflation to fall to 4.6%, despite rising core inflation. According to the MPC, the South African economy is expected to grow by 2.0% in 2022, revised up from 1.7% at the time of the January meeting. This is due to a combination of factors, including stronger growth in 2021 and higher commodity export prices. Growth in economic output in the first quarter of this year is likely to be significantly stronger than expected at the time of the January meeting.

stay high, fuel price inflation should ease in 2023, helping headline inflation to fall to 4.6%, despite rising core inflation. According to the MPC, the South African economy is expected to grow by 2.0% in 2022, revised up from 1.7% at the time of the January meeting. This is due to a combination of factors, including stronger growth in 2021 and higher commodity export prices. Growth in economic output in the first quarter of this year is likely to be significantly stronger than expected at the time of the January meeting.

The risks to the inflation outlook are to the upside. Global producer price and food price inflation continued to surprise higher in recent months and could do so again, particularly if the war in the Ukraine persists into the growing season. Oil prices increased strongly through 2021 and are up again sharply year to date, propelled higher also by the war and economic sanctions. Electricity and other administered prices continue to present short- and medium-term risks. Higher diesel and coal prices may result in upward revisions to our electricity price forecast for 2023. Given below-inflation assumptions for public sector wage growth and higher petrol and food price inflation, considerable risk is attached to a moderate nominal wage forecast.

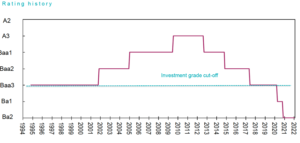

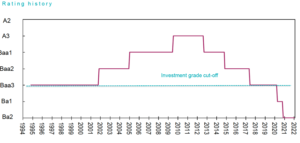

Finally, there was some good news on the ratings front. At the beginning of April Moody’s changed the outlook on the Government of South Africa to stable from negative. Moody’s has affirmed South Africa’s Ba2 long-term local and foreign currency issuer and senior unsecured debt ratings. This may yet herald the turnaround in the directions of ratings and the long road back to investment grade:

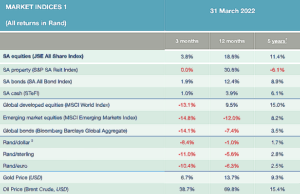

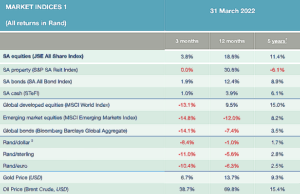

Market Performance

Developed markets around the world bounced back during March – in many instances to levels seen before the armed conflict between Russian and Ukraine broke out earlier this year. The MSCI World Index ended the month 2.8% higher (in US dollars) but emerging markets continued to struggle. The MSCI Emerging Markets index shed another 2.2% in March, taking its losses to almost 7% so far this year.

Visio Capital reports that, while the recovery in developed equities appears at odds with a more hawkish US Federal Reserve, investors are returning to the equity market for inflation protection – a sensible approach if higher interest rates do not push the US economy into recession. Global bond markets remain under pressure – the developed market composite index has recorded its worst month and quarter in over 35 years.

inflation protection – a sensible approach if higher interest rates do not push the US economy into recession. Global bond markets remain under pressure – the developed market composite index has recorded its worst month and quarter in over 35 years.

Local equities ended the month flat. Financials (up 12%) delivered strong performance but this was offset by poor performance in Industrials. Naspers (-13.7%) and Prosus (-15.1%) continued their downward trend. Resources shed 1.1% on average during the month as large gains in iron ore and other basic materials shares were offset by the major platinum miners giving up more than ten percent in March.

Commodity markets were heavily influenced by the events in Ukraine. Laurium Capital reported that, early in the month, the invasion sparked massive volatility in the prices of commodities. A few examples: in energy markets, Brent Crude Oil traded to a peak of over USD130/bl (now USD108) and coal to over USD450/t (now USD260). In metals, palladium peaked at USD3 400/oz (now USD2 260) while nickel was quoted at over USD48 000/t (now USD32 000). NATO and AUKUS-aligned sanctions against Russia forced a rapid and continued recalibration of demand for commodities and reduced forecasts for economic growth.

- Source: Factset

- All performance numbers in excess of 12 months are annualised

- A negative number means fewer rands are being paid per US dollar, so it implies a strengthening of the rand.

Commentary – Taking Stock Of The Energy Shock

Russia is a major supplier of energy (mainly oil and gas) to Europe and other parts of the world. The swift implementation of sanctions against Russia had an obvious impact on the security of energy supply. Blackrock’s Investment Institute delves into this matter below:

on the security of energy supply. Blackrock’s Investment Institute delves into this matter below:

Russia’s invasion of Ukraine is exacting a horrific human toll. In response, nations and governments across the world have come together to sever financial and business ties with Russia. In a drive for energy security, the West is seeking to wean itself off Russian oil and gas – presenting a fresh supply shock in a world that was already shaped by supply. It will make inflation more persistent, slow growth, and stoke demand for non-Russian fossil fuels in the short term.

The scale of the impact depends on how quickly the West reduces its Russian energy imports. Blackrock’s base case scenario is a determined reduction as the West and Russia enter a protracted standoff. The reduction could happen more quickly if the conflict escalates. An easing of tensions could slow the process but is unlikely to stop it.

In the U.S., the energy shock under a protracted standoff scenario is still less than half the 1970s oil supply shock. It will hit consumers and firms, but the economic impact will be smaller than in the past given greater energy efficiency and the U.S.’s role as a net primary energy exporter. Blackrock sees growth staying above trend because the activity restart had generated strong growth momentum prior to the shock.

Outright stagflation is a more serious risk in Europe given its reliance on Russia for roughly 40% of its gas supplies. Blackrock estimates that their baseline scenario could add 1-1.5 percentage points to euro area inflation and shave up to 3 percentage points off growth – or more if energy prices return to their mid-March highs.

They think the risk of inflation expectations de-anchoring – and central banks being forced to slam on the policy brakes in response – has risen. If higher inflation becomes the rule, central banks may destroy demand by raising rates past their neutral point and into restrictive territory.

This shock will probably reinforce the net-zero transition in Europe. The U.S. won’t feel the same push as Europe: it is a net primary energy exporter and has a lower energy cost burden.

Traditional energy stocks are doing well in the short term due to a greater need for additional non-Russian supplies and higher prices. But the transition’s momentum means renewable energy is performing well at the same time.

South African stocks have not been isolated from events in Europe. Thungela is up 175% from the start of the year, Kumba Iron Ore, Sasol, and Exxaro are up between 40% and 50%, and Anglo American over 20%.

What is clearer than ever before is that we live in an interconnected world. A Russian man’s supposed vision of a reunited Soviet Union has reverberated around the world. At the same time, a global move to a greener planet and the resulting inflationary pressures has created a pressure pot of energy and commodity supply shocks. This is a theme that will influence investment markets for some time to come.

Finally, Blackrock sees that the recent attractiveness of non-green energy stocks won’t derail the transition to net-zero energy. The world needs fossil fuels to meet current energy demands, given the way economies are wired today. At the same time, high energy prices ultimately reinforce the drive to cut carbon emissions. Why? They act as a sort of carbon tax on consumers, make renewables more competitive, and spur energy efficiency and innovation. Higher energy prices will hurt U.S. consumers as well, but also herald increased U.S. fossil fuel output. As a result, we may not see the same impetus to reduce emissions there as in Europe. Their conclusion is this: the transition’s path will diverge even more across regions and is likely to create geopolitical tension in years to come. World peace Miss Universe? Not anytime soon…

Page load link

stay high, fuel price inflation should ease in 2023, helping headline inflation to fall to 4.6%, despite rising core inflation. According to the MPC, the South African economy is expected to grow by 2.0% in 2022, revised up from 1.7% at the time of the January meeting. This is due to a combination of factors, including stronger growth in 2021 and higher commodity export prices. Growth in economic output in the first quarter of this year is likely to be significantly stronger than expected at the time of the January meeting.

stay high, fuel price inflation should ease in 2023, helping headline inflation to fall to 4.6%, despite rising core inflation. According to the MPC, the South African economy is expected to grow by 2.0% in 2022, revised up from 1.7% at the time of the January meeting. This is due to a combination of factors, including stronger growth in 2021 and higher commodity export prices. Growth in economic output in the first quarter of this year is likely to be significantly stronger than expected at the time of the January meeting. inflation protection – a sensible approach if higher interest rates do not push the US economy into recession. Global bond markets remain under pressure – the developed market composite index has recorded its worst month and quarter in over 35 years.

inflation protection – a sensible approach if higher interest rates do not push the US economy into recession. Global bond markets remain under pressure – the developed market composite index has recorded its worst month and quarter in over 35 years.

on the security of energy supply. Blackrock’s Investment Institute delves into this matter below:

on the security of energy supply. Blackrock’s Investment Institute delves into this matter below: